Portfolio

Professional portfolio tracking for curious investors. Transform how you monitor, analyze, and grow your investments across global markets. Track stocks, crypto, ETFs, and funds with institutional-grade analytics and intelligent insight with Amsflow Portfolio. Monitor multiple positions per symbol and benchmark against major indices with seamless performance tracking.

World-class Portfolio Management suite engineered for seamless tracking

Move beyond basic portfolio apps with Amsflow Portfolio's intelligent analytics and team collaboration. Monitor performance, analyze holdings, and make informed decisions with real-time insights across all major asset classes.

Multi-Asset

Track stocks, crypto, ETFs, and funds in one unified portfolio. Monitor your complete investment universe with real-time performance insights and seamless asset class integration.

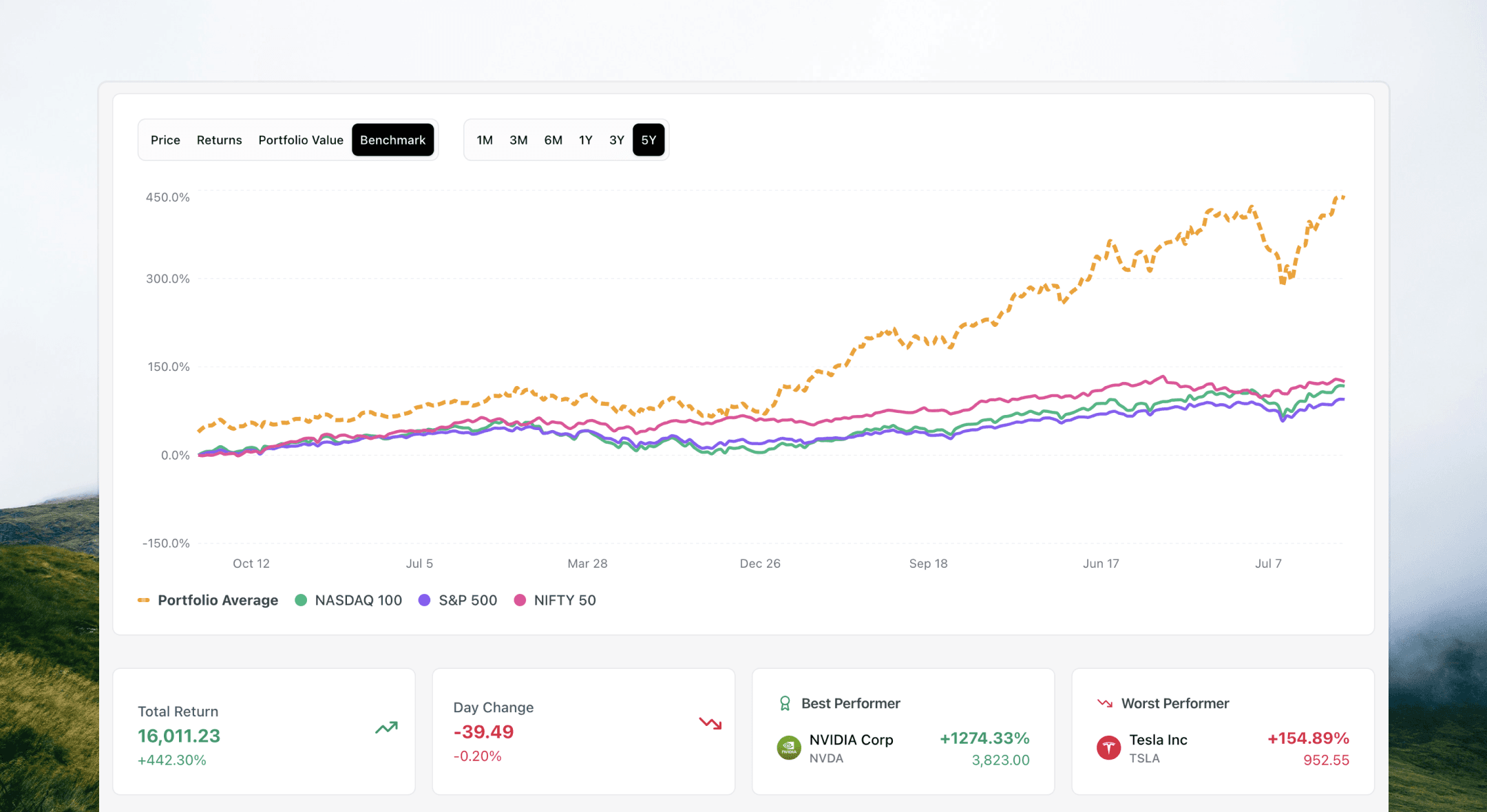

Benchmark

Benchmark portfolio against major indices with instant health scoring. Compare returns to S&P 500, NASDAQ 100, and global markets through performance visualization.

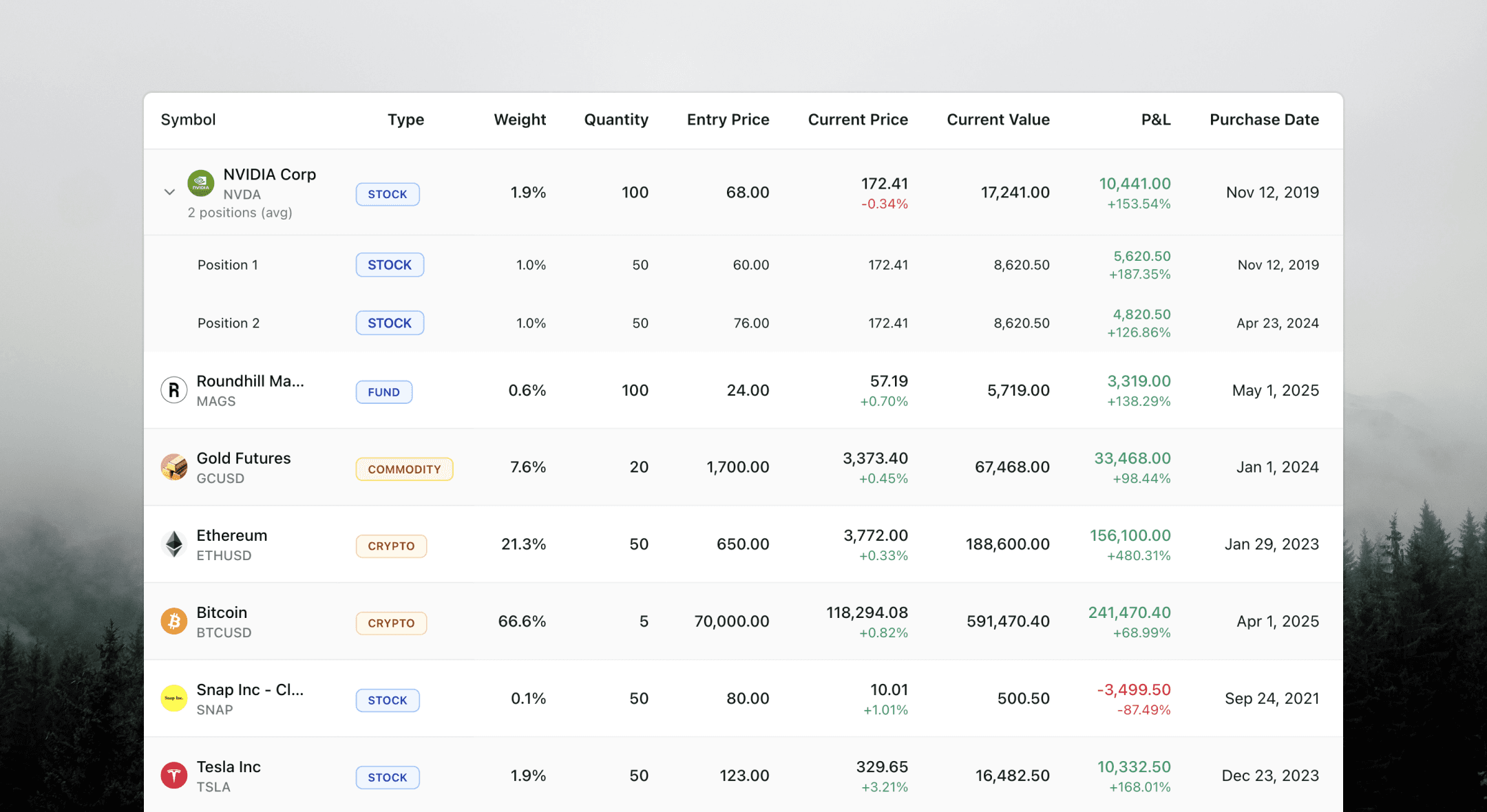

Multiple Position Tracking

Multiple holdings per symbol with individual P&L calculations. Support for different entry prices and dates, with automated averaging and weighted return insights.

Monitoring

24/7 portfolio monitoring with threshold alerts. Customizable notifications for significant movements, tailored to your portfolio size and risk tolerance.

What customers say

Hear from customers who are loving what we've built for them

"Amsflow looks like a powerful all-in-one solution for financial teams! Love the seamless integration of AI insights and collaboration tools."

Dorian

"Great software for stock monitoring and trading. Both Amsflow and my personal investment account matches in terms of profit and losses. Only wished that choosing a date would generate the price like Tykr for that specific day, but I get why it shouldn't. I love how I could generate an AI report for the income statement and balance sheet for each company and it condense it into an easy to digest format."

Peter Vo

"I can only offer my compliments. Initially, I gave it 4 stars in my review because the list of cryptocurrencies was very limited. Within a week, the founder contacted me to let me know that he had added 4,300 cryptocurrencies."

Stefano Bellucci

"Nice software and value for money, it would be far better if it included API."

Noecis Ltd, UK

"I've been using Amsflow Screener for a while now, and it's been a game-changer. Typing metrics and filters is easy and fast; it's by far the best screener I've used. Most screeners are complex, but Amsflow is intuitive."

Tim Scullin

"Amsflow is an exceptional investment research and portfolio management tool that I highly recommend. .The fundamental data, and custom screening features empower me to make well- informed investment decisions.on top of it AJAY is very efficient and top of things, intially canada etf data were missing and he updated in just couple of hours, i am really impress with support"

Ronak

"I am quite happy with the subscription that I have purchased. It is excellent value for money as compared to some of the other services out there. I purchased it for the real time global data available in Amsflow and it does have data on major global markets. The Developers are also super quick - I suggested 4 enhancements to make it easier to use this product - all these were implemented in 1 day. Overall very happy with the purchase."

Sameer

"X-Ray transforms hours of my analysis into instant insights. One click delivers comprehensive stock evaluation with technical signals, pivot points, and anomaly detection - it's like having a seasoned analyst at my fingertips."

Karthikraj Duraisamy

"Most screeners I've used are complex, hard to use, and overcomplicated, but Amsflow Screener is intuitive and straightforward. Finally, using a screener makes sense."

Durgesh Kaushik

"Been using Amsflow for a few months now, and it is my go-to tool for analysis. The Screener is the highlight! I can slice through global markets, filter by metrics that matter to me, and even get AI suggestions from Lisa. The combo of data + AI saves serious time and, more importantly, helps find 'HIDDEN GEMS'. feature, and you should explore it. The Series feature lets me line up different assets, sectors, or even macro indicators and actually see how they’re moving together (or not). Found a few interesting correlations I’d have 100% missed otherwise."

Shreedhar Vepencheri

"I’ve been using Amsflow for the last 6–7 months, and it’s by far the best financial research platform I’ve used. I was fortunate enough to get early access to the Amsflow Screener, and it truly feels magical. As far as I know, only two screeners offer global data: TradingView and the Amsflow Screener. I prefer the Amsflow Screener because it’s so simple to use, especially with its query builder. The Lisa Screener Agent is also incredibly helpful whenever I’m unsure which metrics to use. I would highly recommend it for finding swing stocks or for long-term investing."

Arjun

Transform your portfolio tracking

Start your free 7-day, risk-free trial. We'll email you one day before it ends.

FAQ

What assets can I track in Amsflow Portfolio?

Amsflow Portfolio supports multi-asset tracking across stocks, cryptocurrencies, ETFs, and mutual funds in a single unified view. You can monitor your complete investment universe across global markets with real-time performance insights and seamless asset class integration.

How does portfolio performance benchmarking work?

Amsflow Portfolio provides advanced performance analytics with benchmark comparison against major global indices including S&P 500, NASDAQ 100, and NIFTY 50. You get portfolio health scoring through profitability metrics, financial health indicators, and real-time day change tracking with percentage movement visualization.

Can I track multiple positions in the same stock with different entry prices?

Yes, Amsflow Portfolio supports multiple position holdings for the same symbol/ticker with different entry prices and purchase dates. Each position is tracked individually with separate P&L calculations, plus automated position averaging and weighted return calculations across multiple entries.

How do portfolio alerts and monitoring work?

Amsflow Portfolio provides 24/7 portfolio monitoring with customizable threshold-based alerts for significant changes. You can set Portfolio Monitor notifications for major P&L movements beyond user-defined thresholds, with configurable alert sensitivity tailored to different portfolio sizes and risk tolerances.

What team collaboration features are available for portfolios?

Team plan customers get shared portfolio access enabling collaborative investment management. Features include team-wide portfolio visibility with shared performance metrics, holdings analysis, and collaborative decision-making through unified portfolio insights and team discussions.

How does the Portfolio Digest feature work?

Portfolio Digest provides opt-in performance summary emails with comprehensive performance summaries and holdings analysis. You can choose flexible digest frequency options including daily, weekly, or monthly delivery schedules, featuring holdings performance breakdown with key changes and notable movements.

What financial metrics are integrated into portfolio analysis?

Amsflow Portfolio integrates quarterly and annual financial metrics for all portfolio holdings, including revenue, net income, and profitability analysis for individual positions. You get P/E ratios, ROE, and margin analysis across portfolio companies, plus fundamental analysis integration with portfolio weighting considerations for informed decision-making.

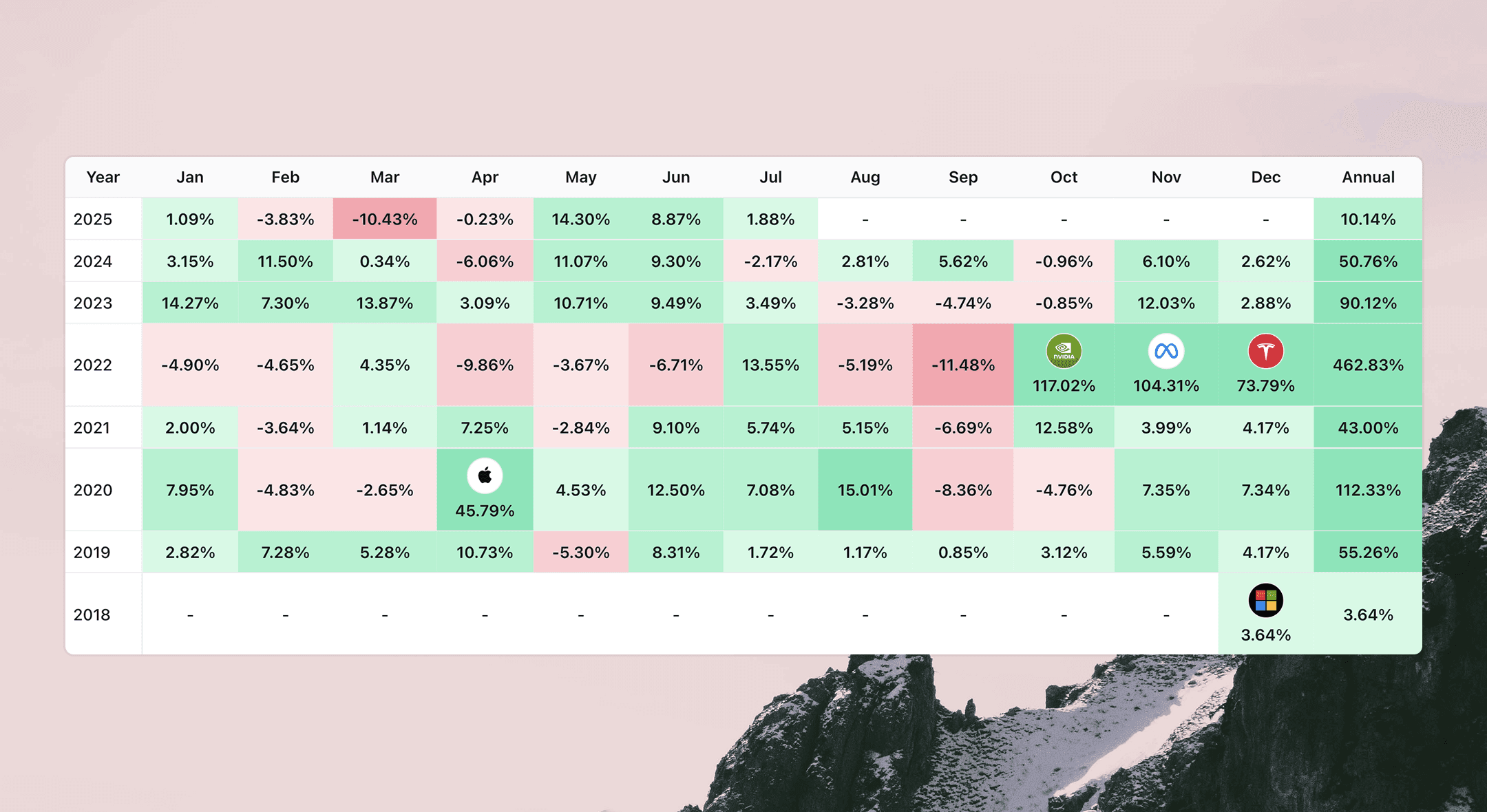

How does the Portfolio Returns Heat Map work?

The Portfolio Returns Heat Map provides month-over-month portfolio performance visualization in an intuitive color-coded matrix. This powerful visualization tool transforms your historical performance data into an easy-to-read format, helping you quickly identify performance patterns, seasonal trends, and portfolio behavior over time.

Amsflow is for research and educational purposes only. Not financial advice. Amsflow doesn't recommend specific investments or securities. Market participation involves substantial risk, including potential loss of principal. Past performance doesn't guarantee future results. Amsflow doesn't offer fund/portfolio management services in any jurisdiction. Amsflow is a data platform only. Amsflow doesn't provide investment tips. Be cautious of imposters claiming to be Amsflow.