Best Stock Screeners — In-Depth Review & Comparison

Finding the right stocks in a noisy market is harder than ever. Traditional screeners can feel clunky, limited to basic filters and outdated interfaces. A truly modern screener must be more than a data table—it must be an intelligent research partner that cuts through the confusion.

The new benchmark for 2025 demands AI-driven natural language search, real-time global data, deep technical and fundamental fusion, and seamless team collaboration. With this standard in mind, we put the innovative Amsflow Screener to the test against seven established giants: Trade Ideas, FINVIZ, TradingView, Stock Rover, Zacks, Koyfin, Seeking Alpha, and YCharts. Let's see who delivers the clarity, power, and precision needed to find your next winning stock.

Feature Snapshot

| Screener Capabilities | Amsflow | Trade Ideas | FINVIZ | TradingView | Stock Rover | Zacks | Koyfin | YCharts | Seeking Alpha |

|---|---|---|---|---|---|---|---|---|---|

| Global coverage | |||||||||

| AI / natural-language search | |||||||||

| Inline query builder | |||||||||

| Dynamic column addition | |||||||||

| Tech + fundamental filters | 550+ metrics | Basic | Basic | Fundamentals-only | Fundamentals-only | 500+ metrics | Comprehensive fundamentals | Basic | |

| Collaboration / Shared Screeners |

Amsflow Screener

The Amsflow Screener is engineered for both power and simplicity, offering a truly global, real-time screening experience across more than 70,000 stocks. Its standout feature is the "Lisa" AI agent, which lets users create sophisticated queries in plain English, such as "Find semiconductor stocks with over 20% EPS growth and strong bullish momentum."What sets Amsflow apart is its unique inline query builder, which dynamically auto-suggests relevant metrics and filters as you type, eliminating the need to remember or manually navigate through hundreds of metrics. Columns are intelligently added based on your query context, dramatically simplifying the user experience.

Pros

- Global real-time coverage (100,000+ tickers).

- Lisa AI translates natural language into precise filters.

- Intelligent inline query builder auto-suggests metrics and filters dynamically.

- Automatic dynamic column addition based on query context.

- Clean, responsive UI with intuitive dark mode.

- Shared screeners for teams.

- Competitive pricing tiers from $19/mo (free 7-day trial).

- No signup required to test the screener before purchasing.

Cons

- Fewer third-party integrations compared to established competitors.

Trade Ideas

The Trade Ideas screener is a high-performance tool built specifically for day traders who need to identify real-time opportunities in the US and Canadian markets. Its core strength lies in its server-side processing, which scans the market tick-by-tick to deliver instant alerts based on over 500 criteria. The platform's AI, "Holly," runs thousands of proprietary trading algorithms daily to identify high-probability setups. Trade Ideas also features a powerful backtesting module, enabling traders to validate their strategies on historical data. Direct integration with popular brokers allows for one-click execution from the screener, making it an end-to-end solution for active trading.

Pros

- Lightning-fast intraday scanning & alerts.

- Holly AI generates trade ideas daily.

- Broker integration for auto-execution.

- Granular back-testing on historical ticks.

Cons

- North-America equities only.

- Desktop-centric, no full mobile parity.

- High price point ($127–$254 / mo).

- Steep learning curve for casual users.

- No natural-language screening.

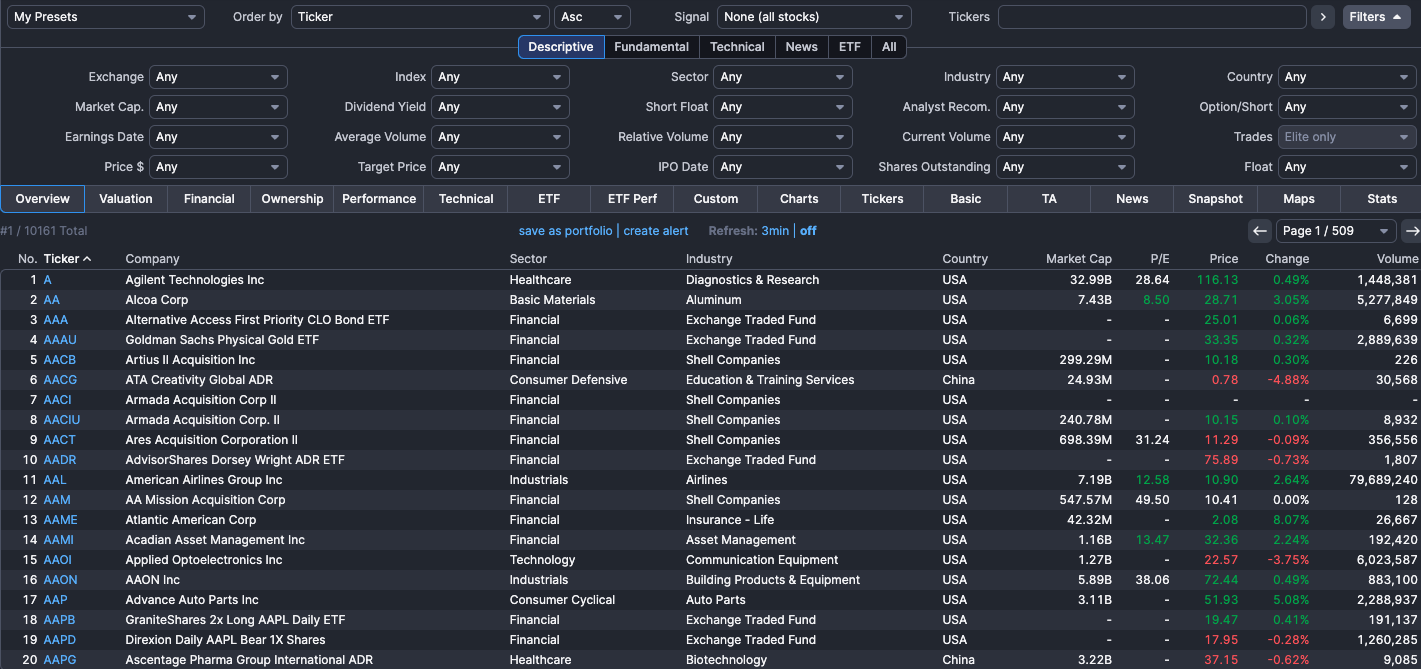

FINVIZ

The FINVIZ screener is one of the most popular free tools on the web, renowned for its speed and highly visual interface. It provides a comprehensive set of filters covering descriptive, fundamental, and technical criteria for US-listed stocks. Users can quickly sift through thousands of equities using sliders and dropdown menus for metrics like P/E ratio, dividend yield, and analyst ratings. Its iconic heatmaps offer an instant overview of market performance. While the free version operates on a 15-minute delay, the Elite subscription unlocks real-time data, advanced charting, and backtesting capabilities, making it a versatile tool for both quick scans and more detailed analysis.

Pros

- Instant visual heat-maps & hover charts.

- Free tier for end-of-day scans.

- Simple, beginner-friendly UI.

Cons

- 15-minute delayed data unless Elite.

- Limited metric depth (~70 fields).

- No dedicated mobile app, ads on free version.

- No AI / natural-language screening.

- Only US equities.

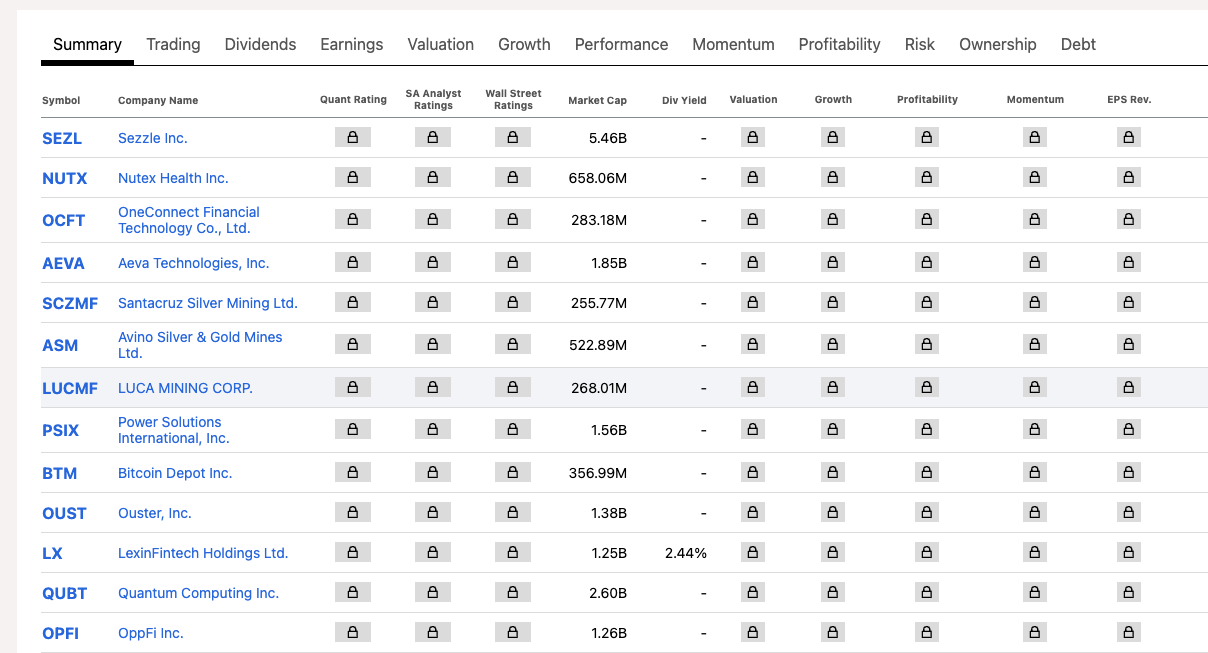

Seeking Alpha

Seeking Alpha’s stock screener centers on its proprietary Quant Rating system, which crunches 100-plus fundamental and price-action metrics to grade every U.S. stock and ADR across value, growth, profitability, momentum, and EPS-revision factors. Premium users unlock real-time quotes, an ETF screener, and unlimited saved screens, while the free tier provides delayed data and basic filters. Integrated dividend-safety grades, author insights, and Wall-Street ratings make it a one-stop shop for fundamentals-driven investors.

Pros

- Back-tested Quant Ratings that have outperformed the S&P 500 over time.

- 100 + filterable metrics plus factor & dividend grades.

- Links straight into community articles and analyst research.

- ETF screener and mobile app support.

- Custom screens can be saved and exported.

Cons

- Real-time data and many filters sit behind a paywall.

- Table-centric UI—no visual heat-maps or charts.

- International coverage limited mainly to U.S. listings and ADRs.

- Ads on the free tier.

- No natural-language / AI screening.

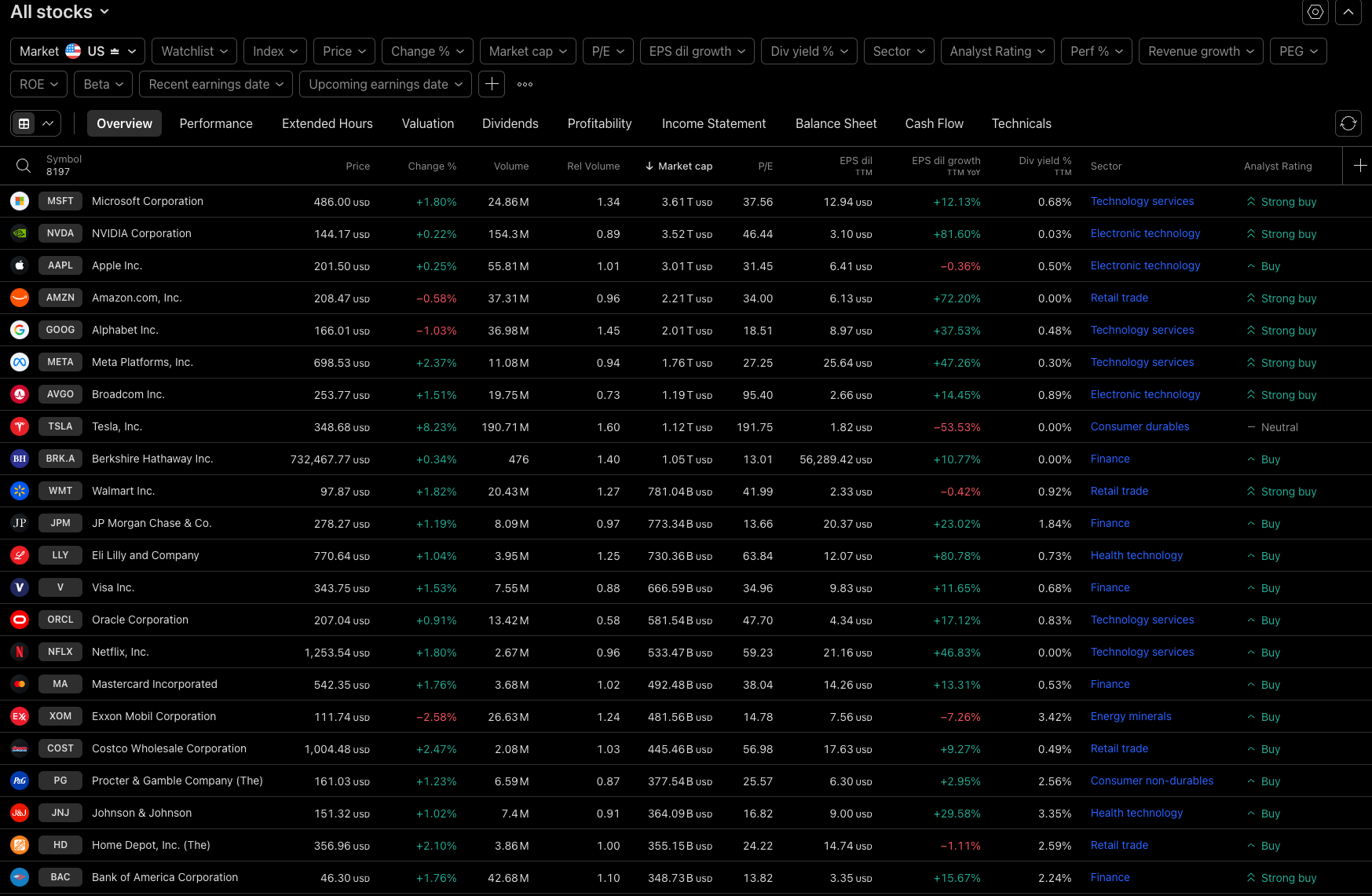

TradingView

TradingView's stock screener is a deeply integrated feature of its world-renowned charting platform, offering extensive screening capabilities across a vast universe of global stocks, forex, and cryptocurrencies. Users can filter securities based on hundreds of fields, including detailed financial data, technical indicators, and performance metrics across multiple timeframes. A key strength is its customizability; investors can use the proprietary Pine Script language to create their own complex filters and indicators. The screener is fully synchronized with TradingView's powerful charts and social trading features, allowing for seamless analysis and idea sharing within its active community.

Pros

- World-class interactive charts.

- Global multi-asset coverage (stocks, FX, crypto, futures).

- Active community & thousands of scripts.

- Affordable entry tier + free plan.

Cons

- Limited Metric.

- Overwhleming UI

- Advanced workflows often require scripting.

- No AI / natural-language screening.

- Exchange real-time feeds cost extra.

- No Inline Query Builder.

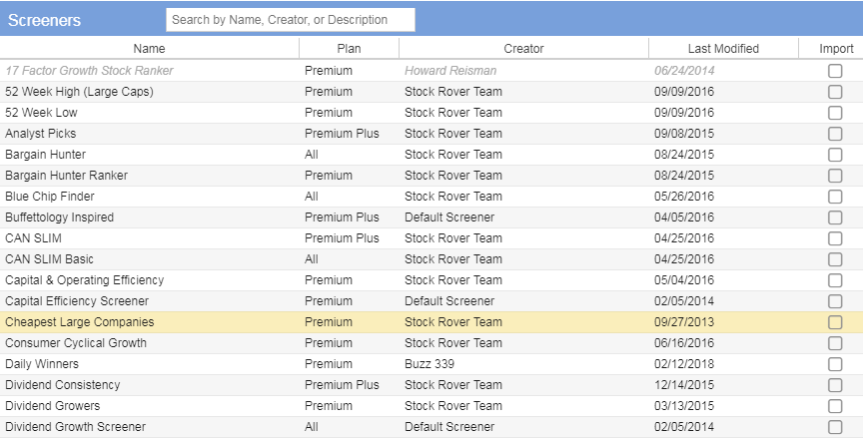

Stock Rover

The Stock Rover screener is designed for fundamental investors who prioritize deep, data-rich analysis over real-time speed. It offers an extensive library of over 650 financial, operational, and valuation metrics, complete with a decade of historical data for US and Canadian equities. This allows for powerful screening based on long-term performance and financial health. Stock Rover is particularly known for its "Guru Strategies," which are pre-built screeners based on the methodologies of famous investors like Warren Buffett and Peter Lynch. The platform also excels at portfolio analysis, enabling users to screen within their own holdings and benchmark against various indices.

Pros

- Deep ten-year fundamental database.

- Portfolio rebalancing & benchmarking.

- Value/Growth scoring models included.

- Budget-friendly pricing ($8-$19 / mo).

Cons

- No real-time quotes or intraday scans.

- North-America equities only.

- Sparse technical indicators.

- No natural-language screening.

- No Inline Query Builder.

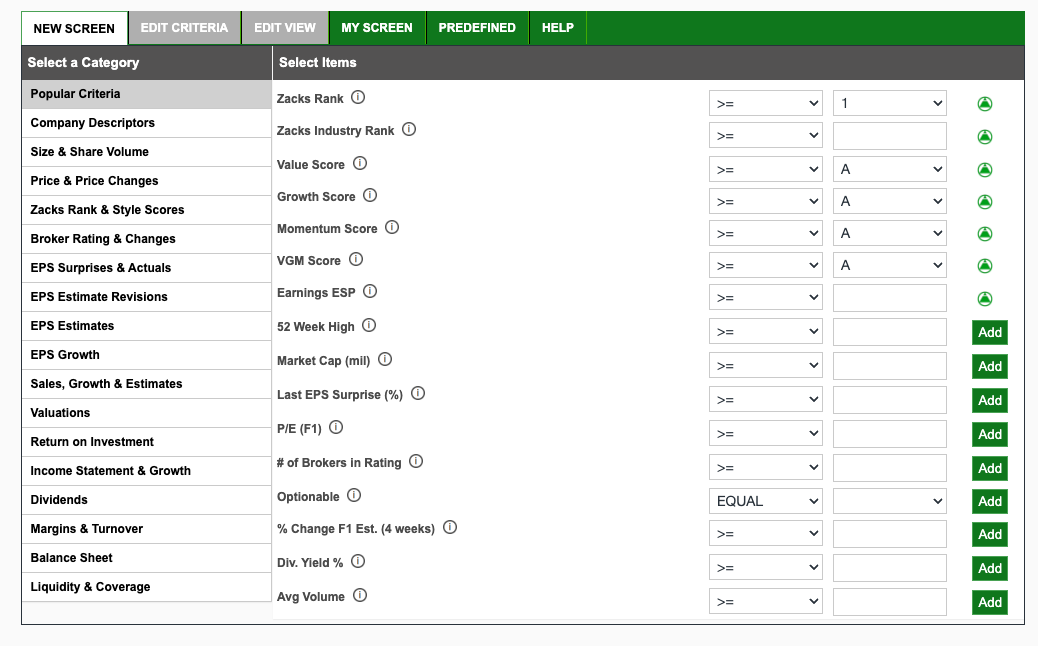

Zacks Screener

The Zacks Screener is built upon the company's renowned earnings-focused research, making it a powerful tool for investors who believe that earnings estimate revisions are a primary driver of stock prices. Its key feature is the integration of the proprietary Zacks Rank, which rates stocks from #1 (Strong Buy) to #5 (Strong Sell) based on the timeliness and magnitude of analyst estimate revisions. The screener allows users to filter the universe of US stocks using a wide array of fundamental metrics, with a particular emphasis on EPS-related data points. While the free version provides robust end-of-day screening, the premium subscription unlocks real-time data and access to more exclusive Zacks ratings and reports.

Pros

- Hundreds of proprietary earnings filters free.

- Zacks Rank & style scores add edge.

- Affordable annual Premium tier.

Cons

- End-of-day data only on free version.

- Few technical indicators.

- No AI / natural-language screening.

- Only US equities.

- Interface less modern than peers.

- No Inline Query Builder.

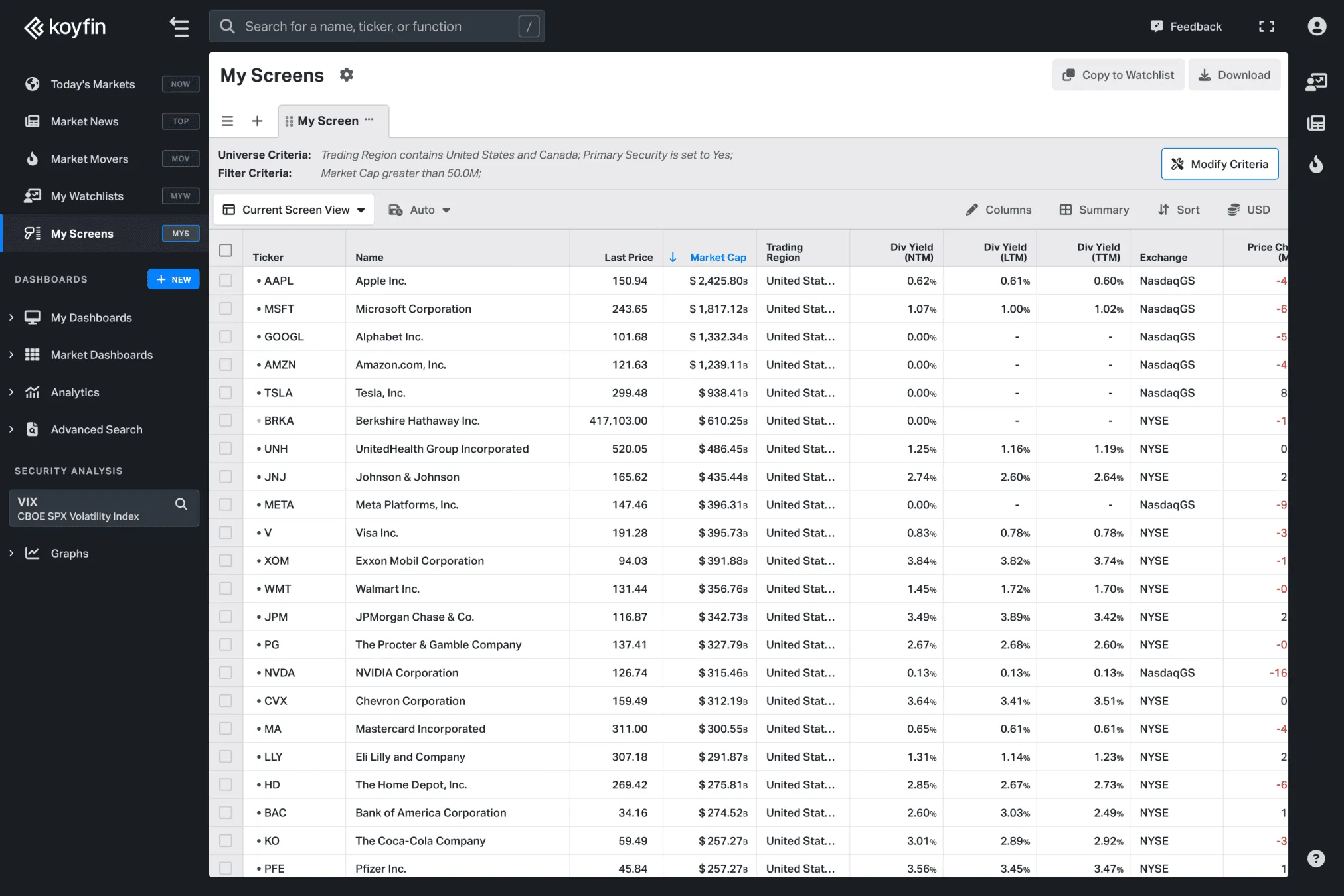

Koyfin Screener

Koyfin's screener is a professional-grade tool designed for in-depth financial analysis, offering a powerful combination of fundamental and macroeconomic data. It allows users to screen a global universe of stocks, ETFs, and mutual funds using over 400 metrics, including detailed financial statement data, valuation ratios, and analyst estimates. Koyfin excels in its ability to create custom formulas and visualize data through sophisticated charts and dashboards. This makes it particularly useful for analysts who need to understand the broader economic context driving their investment decisions. While it lacks the AI-driven queries of some newer platforms, its data depth and customization capabilities are top-tier.

Pros

- 400+ fundamental metrics with global coverage.

- Macro dashboards integrate economic data.

- Real-time U.S. quotes; delayed global feeds.

- Rich visualisations & multi-chart view.

- Affordable Plus/Pro tiers; free starter.

Cons

- No AI / natural-language screening.

- Limited technical indicators.

- No true team collaboration layer.

- No Inline Query Builder.

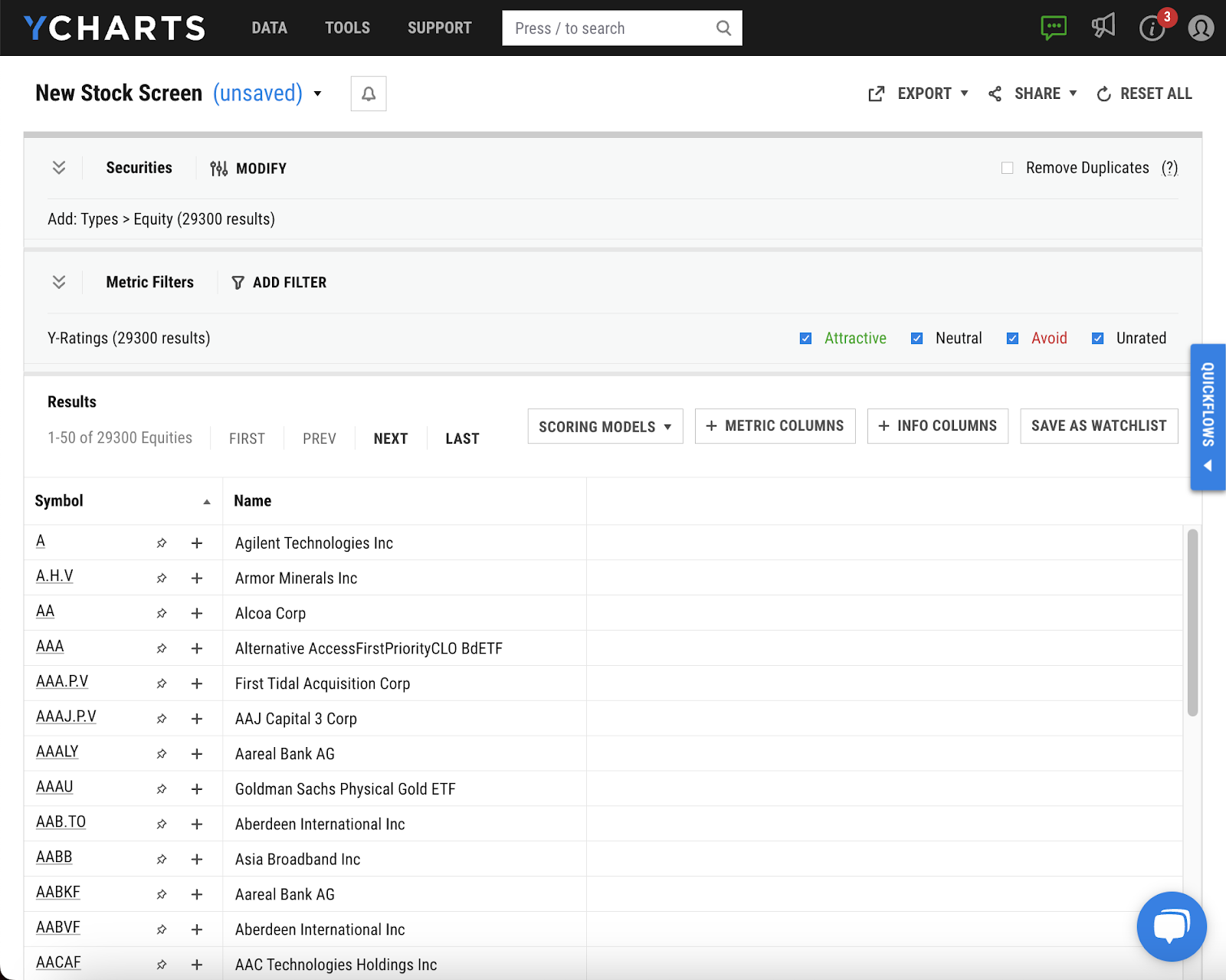

YCharts Screener

The YCharts screener is a powerful tool for financial advisors and institutional investors who require extensive fundamental data and sophisticated analysis capabilities. It offers access to thousands of financial metrics for over 20,000 global equities, ETFs, and mutual funds. A key feature of the YCharts screener is the ability to create complex custom formulas, allowing users to build and test their own proprietary scoring models. The platform is also known for its "Excel Add-in," which enables seamless data export for further analysis and the creation of presentation-ready charts and reports. While it offers basic technical filters, its core strength lies in its comprehensive fundamental database and customization.

Pros

- Extensive fundamental & ratio database.

- Excel / Google Sheets data connectors.

- Presentation-ready charts & PDF reports.

- Custom formula screener for advanced users.

Cons

- Mostly end-of-day quotes; limited real-time.

- Minimal technical or AI features.

- Outdated UI.

- No built-in team collaboration layer.

- High cost aimed at professionals ($300+/mo).

- No Inline Query Builder.

Pricing at a Glance

| Platform | Free Tier | Entry | Premium |

|---|---|---|---|

| Amsflow | $19/mo | $80/mo | |

| Trade Ideas | $127/mo | $254/mo | |

| FINVIZ | $39.50/mo | — | |

| TradingView | $14.95/mo | $59.95/mo | |

| Stock Rover | $7.99/mo | $27.99/mo | |

| Zacks | $249/yr | — | |

| Koyfin | $39/mo | $79/mo | |

| YCharts | $300/mo* | $500/mo* | |

| Seeking Alpha | $19.99/mo | $160/mo |

*YCharts and Seeking Alpha pricing is billed annually. Prices are per user per month. All prices are subject to change.

Final Verdict

Each screener has a sweet spot: Trade Ideas for ultra-active trading; FINVIZ for speedy free scans; TradingView for global charting; Stock Rover for deep value research; Zacks for earnings filters; Koyfin for macro-fundamental mash-ups; YCharts for data exports and client reporting. Amsflow Screener blends their most-wanted capabilities — real-time global coverage, AI simplicity, multi-factor filters, advanced technical insights and collaboration — into one cohesive, mobile-ready workspace at a competitive price. For investors seeking an all-in-one screener that scales from solo portfolios to institutional desks, Amsflow remains the most balanced choice for 2025.

FAQ

What is a stock screener?

A stock screener is a research tool that filters thousands of securities using fundamental, technical or descriptive criteria—such as valuation ratios, sector or price action—to surface equities that match a specific strategy or thesis.

What features are essential in choosing a stock screener?

Look for real-time data if you trade intraday, breadth of fundamental and technical metrics, global coverage, intuitive UX (or AI assistance), flexible alerts, export / API options and transparent pricing that scales with your needs.

What are the different types of stock screeners?

Broadly: (1) Fundamental screeners focused on earnings, cash-flow and valuation metrics; (2) Technical screeners based on price, volume and indicators; (3) Hybrid / AIscreeners—like Amsflow—that combine both realms with real-time analytics and natural-language queries.

Transform Your Stock Screening Experience

Start your 7-day complimentary trial. Accelerate your investment research productivity with Amsflow Screener.

Resources

Best Financial Analysis Platforms

Compare the best financial analysis platforms

Best SP Capital IQ Pro Alternatives

Compare the best SP Capital IQ Pro alternatives

Best Bloomberg Terminal Alternatives

Compare the best Bloomberg Terminal alternatives

Best YCharts Alternatives

Compare the best YCharts alternatives

Best Koyfin Alternatives

Compare the best Koyfin alternatives

Best Seeking Alpha Alternatives

Compare the best Seeking Alpha alternatives

Best Stock Screeners

Compare the best stock screeners

Best GuruFocus Alternatives

Compare the best GuruFocus alternatives

Best Simply Wall St Alternatives

Compare the best Simply Wall Street alternatives

Best FactSet Alternatives

Compare the best FactSet alternatives

Best TipRanks Alternatives

Compare the best TipRanks alternatives

Best MarketBeat Alternatives

Compare the best MarketBeat alternatives

Best Zacks Alternatives

Compare the best Zacks alternatives

Best TIKR Alternatives

Compare the best TIKR alternatives

Best Stock Rover Alternatives

Compare the best Stock Rover alternatives

Best Finviz Alternatives

Compare the best Finviz alternatives

Amsflow is for research and educational purposes only. Not financial advice. Amsflow doesn't recommend specific investments or securities. Market participation involves substantial risk, including potential loss of principal. Past performance doesn't guarantee future results. Amsflow doesn't offer fund/portfolio management services in any jurisdiction. Amsflow is a data platform only. Amsflow doesn't provide investment tips. Be cautious of imposters claiming to be Amsflow.