Best Bloomberg Terminal Alternatives — In-Depth Review & Comparison

Bloomberg Terminal has dominated financial markets for decades, but its $24,000+ annual cost, 1980s-era interface, and steep learning curve are pushing investment professionals toward modern alternatives. Today's market demands more than just comprehensive data—teams need intuitive interfaces, AI-powered insights, and seamless collaboration tools.

The best Bloomberg Terminal alternatives combine the data depth that professionals require with modern user experiences, intelligent AI assistance,competitive pricing, and collaborative team workflows. We've evaluated the top Bloomberg alternatives including Amsflow, Refinitiv Eikon, FactSet, YCharts, Koyfin, S&P Capital IQ, and TradingView to help you find the perfect Bloomberg Terminal replacement for your investment workflow.

Bloomberg Terminal vs Top Alternatives

| Bloomberg Alternative Features | Bloomberg Terminal | Amsflow | Refinitiv Eikon | FactSet | YCharts | Koyfin | TradingView |

|---|---|---|---|---|---|---|---|

| Modern UI/UX | Basic | Basic | Basic | ||||

| AI-Powered Analysis | |||||||

| Portfolio Monitoring | |||||||

| Screener | Basic | 500+ Metrics and 8000+ Filters | Basic | Basic | Basic | Basic | |

| Screnner using natural language | |||||||

| Screener Inline Query Builder | |||||||

| Screener Global Coverage | Limited | Limited | Limited | Limited | Limited | ||

| Returns Heat Map | |||||||

| Comprehensive Alerts | Limited | Fundamental, Technical, Portfolio, and Market | Limited | Limited | Limited | Limited | Limited |

| Natural Language Search | |||||||

| World-class Portfolio Management | Basic | Basic | |||||

| Multi-Asset Portfolio Tracking | Limited | Limited | |||||

| Team Collaboration | Basic | Shared Watchlists, Real-time Team Discussions, Team Portfolios, Team Alerts, Team Screens & Teams Series | Basic | Basic | Basic | Basic | |

| Correlation Analysis | |||||||

| Technical Charting | Basic | Technical indicators, Multi-Panel Chart Layouts, In-line Chart Alerts & Drawing Tools | Basic | Basic | Basic | Basic | |

| Fundamental Analysis | Basic | ||||||

| Global Market Data | Limited | ||||||

| Calendar Suite (Economic, Earnings, IPO) | |||||||

| Global Calendar Suite | Limited | Limited | Limited | Limited | |||

| Learning Curve | Very High | Low | High | High | Medium | Medium | Low |

| Setup Time | Weeks | Minutes | Days | Days | Hours | Hours | Minutes |

| Enterprise Cost Per Seat (Annual) | $24,000+ | $4,560+ | $22,000+ | $12,000+ | $3,600+ | $948+ | $2,100+ |

| Starting Price for Individual users | $19/mo | $300/mo | Freemium | Freemium |

Why Investment Teams Are Leaving Bloomberg Terminal

While Bloomberg Terminal remains the incumbent leader, investment professionals are increasingly seeking alternatives due to several critical limitations:

Bloomberg Terminal Challenges

- Extreme Cost: $24,000+ per user annually with mandatory contracts.

- Outdated Interface: 1980s design requiring extensive training.

- Poor Mobile Experience: Limited functionality outside desktop.

- Steep Learning Curve: Months of training to become proficient.

- No AI Integration: Manual navigation through complex menus.

- Limited Collaboration: Antiquated messaging system.

Modern Alternative Benefits

- Cost Effective: 80-95% cost savings vs Bloomberg.

- Intuitive Design: Modern interfaces requiring minimal training.

- Mobile Optimized: Full functionality on any device.

- Quick Onboarding: Start analyzing within minutes.

- AI-Powered Insights: Natural language queries and automated analysis.

- Team Collaboration: Real-time sharing and communication.

Transform your investment journey with Amsflow

Powerfull Intelligence, Smart Alerts, Advanced Screening & Portfolio Tracking. Never miss movements, discover opportunities, analyze global markets. All in One Sleek Platform.

Amsflow — The Modern Bloomberg Terminal Alternative

Amsflow stands out as the most comprehensive Bloomberg Terminal alternative, delivering institutional-quality analysis through a modern, AI-powered platform. Unlike Bloomberg's complex command structure, Amsflow's Lisa AI assistant understands natural language queries like "Find undervalued European banks with strong ROE" and instantly generates sophisticated analysis across 100,000+ global securities.What truly sets Amsflow apart is its world-class Portfolio Management suite—engineered for seamless tracking with institutional-grade analytics that Bloomberg Terminal simply cannot match. While Bloomberg offers basic portfolio functions buried in complex menus, Amsflow's Portfolio provides comprehensive multi-asset tracking (stocks, crypto, ETFs, funds), intelligent benchmarking against major indices, multiple position tracking per symbol with individual P&L calculations, and 24/7 portfolio monitoring with threshold alerts. Combined with real-time team collaboration through shared watchlists, team discussions, and coordinated alert systems, Amsflow transforms how investment teams work together.

Why Choose Amsflow Over Bloomberg Terminal

- 96% cost reduction vs Bloomberg Terminal ($19/mo vs $2,000/mo).

- World-class Portfolio suite with multi-asset tracking and institutional-grade analytics.

- Multiple position tracking per symbol with individual P&L calculations.

- Intelligent benchmarking against major indices with instant health scoring.

- 24/7 portfolio monitoring with customizable threshold alerts.

- AI-native platform with Lisa assistant and X-Ray analysis.

- Modern, intuitive interface requiring zero training.

- Comprehensive team collaboration features.

- Full mobile functionality for global market access.

- Natural language search eliminates command memorization.

Considerations

- Newer platform with fewer legacy integrations.

- Bloomberg's messaging network not available.

- Limited historical data compared to Bloomberg's decades of archives.

Refinitiv Eikon — The Enterprise Bloomberg Alternative

Refinitiv Eikon (now LSEG Workspace) positions itself as the primary enterprise Bloomberg Terminal alternative, offering similar data comprehensiveness with a somewhat more modern interface. While it provides extensive global market coverage and robust analytical tools, Eikon struggles with the same fundamental issues as Bloomberg—complex navigation, steep learning curves, and enterprise-focused pricing that limits accessibility.

As a Bloomberg alternative, Eikon offers stronger Excel integration and slightly better workflow organization. However, the platform still requires significant training investment and lacks the AI-powered insights that modern teams expect. The interface, while improved from Bloomberg's 1980s design, remains fragmented across multiple modules that don't integrate seamlessly.

Pros as Bloomberg Alternative

- Comprehensive global market data coverage.

- Better interface than Bloomberg Terminal.

- Strong Excel integration and API access.

- Extensive research and news content.

- Slightly lower cost than Bloomberg.

Cons vs Modern Alternatives

- Still expensive ($22,000+ annually).

- Complex, fragmented user interface.

- Requires extensive training like Bloomberg.

- No AI-powered insights or natural language search.

- Limited mobile functionality.

- Outdated collaboration features.

FactSet — The Enterprise Bloomberg Alternative

FactSet has emerged as a popular Bloomberg Terminal alternative among large institutional investors, offering a more modern interface than Bloomberg Terminal and improved collaboration features. While FactSet provides solid analytical tools and customizable dashboards, it pales in comparison to Amsflow's world-class portfolio management suite and lacks the intuitive user experience that modern investment teams demand.

As a Bloomberg alternative, FactSet attempts to modernize traditional terminal functionality but maintains the enterprise complexity and high costs that drive teams toward truly modern solutions. Unlike Amsflow's comprehensive portfolio visualizer and AI-powered insights, FactSet still requires significant training investment and complex setup processes that hinder team productivity.

Pros as Bloomberg Alternative

- Better interface than Bloomberg Terminal.

- Institutional-grade data coverage.

- Some collaboration features.

- Customizable dashboards available.

- Better mobile experience than Bloomberg.

Cons vs Modern Alternatives Like Amsflow

- High enterprise pricing ($12,000+ annually).

- Still requires extensive training.

- Complex setup and customization process.

- No AI integration or natural language search.

- Inferior portfolio management vs Amsflow's world-class suite.

- Enterprise-focused vs user-friendly design.

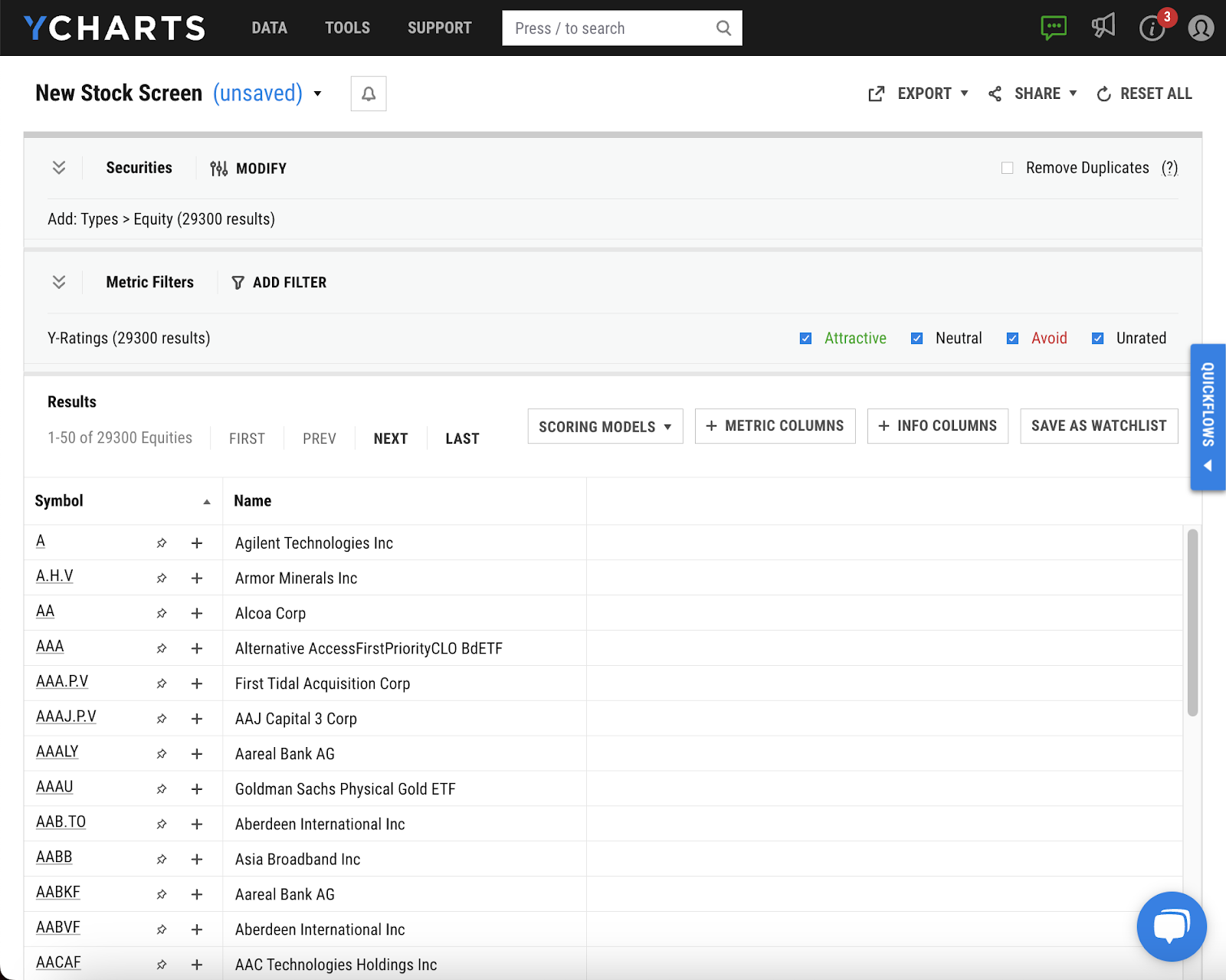

YCharts — The Advisor-Focused Bloomberg Alternative

YCharts serves as a Bloomberg Terminal alternative specifically designed for financial advisors and smaller investment firms. The platform provides extensive fundamental data and creates presentation-ready charts and reports, making it popular for client communication and portfolio management. While more accessible than Bloomberg Terminal, YCharts suffers from an outdated interface that hasn't evolved with modern design standards.

As a Bloomberg alternative, YCharts offers significantly lower pricing and easier onboarding, but the user experience remains frustrating by contemporary standards. The platform lacks the real-time collaboration features and AI-powered insights that modern teams expect, feeling more like a data export tool than an integrated analysis platform.

Pros as Bloomberg Alternative

- Much lower cost than Bloomberg Terminal.

- Extensive fundamental data coverage.

- Good Excel integration and data export.

- Presentation-ready charts and reports.

- Advisor-focused workflow design.

Cons vs Modern Alternatives

- Outdated interface and user experience.

- Limited real-time data and technical analysis.

- No AI features or natural language search.

- Minimal collaboration capabilities.

- Still expensive for smaller teams ($300+ monthly).

- Poor mobile functionality.

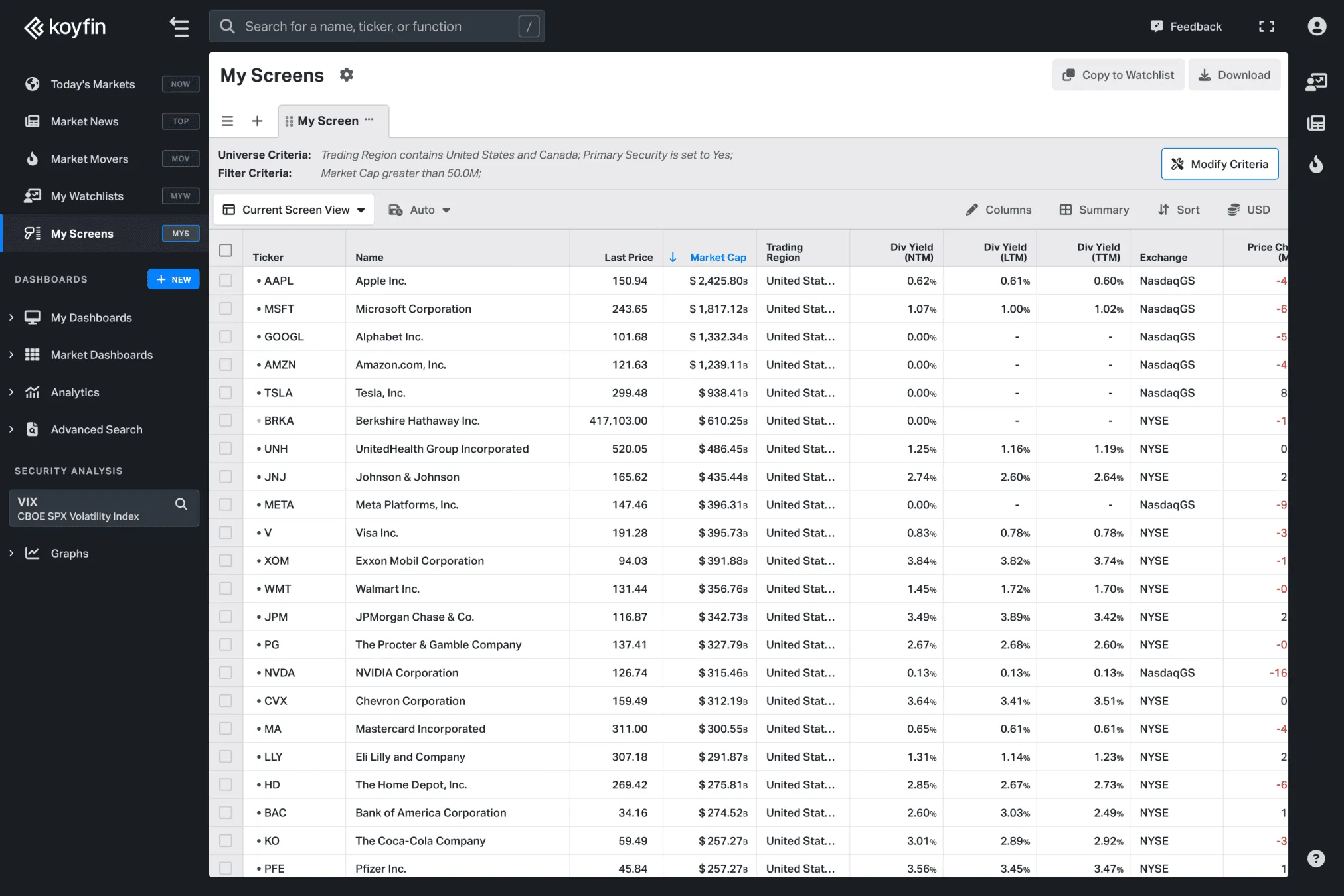

Koyfin — The Budget Bloomberg Alternative

Koyfin represents one of the more affordable Bloomberg Terminal alternatives, offering decent fundamental data coverage and a cleaner interface than legacy platforms. The platform provides solid global market coverage and reasonable charting capabilities, making it attractive to individual investors and smaller teams seeking Bloomberg-like functionality without enterprise pricing.

As a Bloomberg alternative, Koyfin succeeds in providing accessible fundamental analysis tools with better visual design than Bloomberg Terminal. However, it lacks the advanced features, AI integration, and collaboration capabilities that make modern alternatives like Amsflow more compelling for professional teams.

Pros as Bloomberg Alternative

- Affordable pricing with free tier available.

- Cleaner interface than Bloomberg Terminal.

- Good fundamental data and macro analysis.

- Global market coverage.

- Reasonable charting capabilities.

Cons vs Advanced Alternatives

- No AI features or natural language search.

- Basic collaboration and team features.

- Limited technical analysis capabilities.

- Still requires learning complex navigation.

- Mobile experience not optimized.

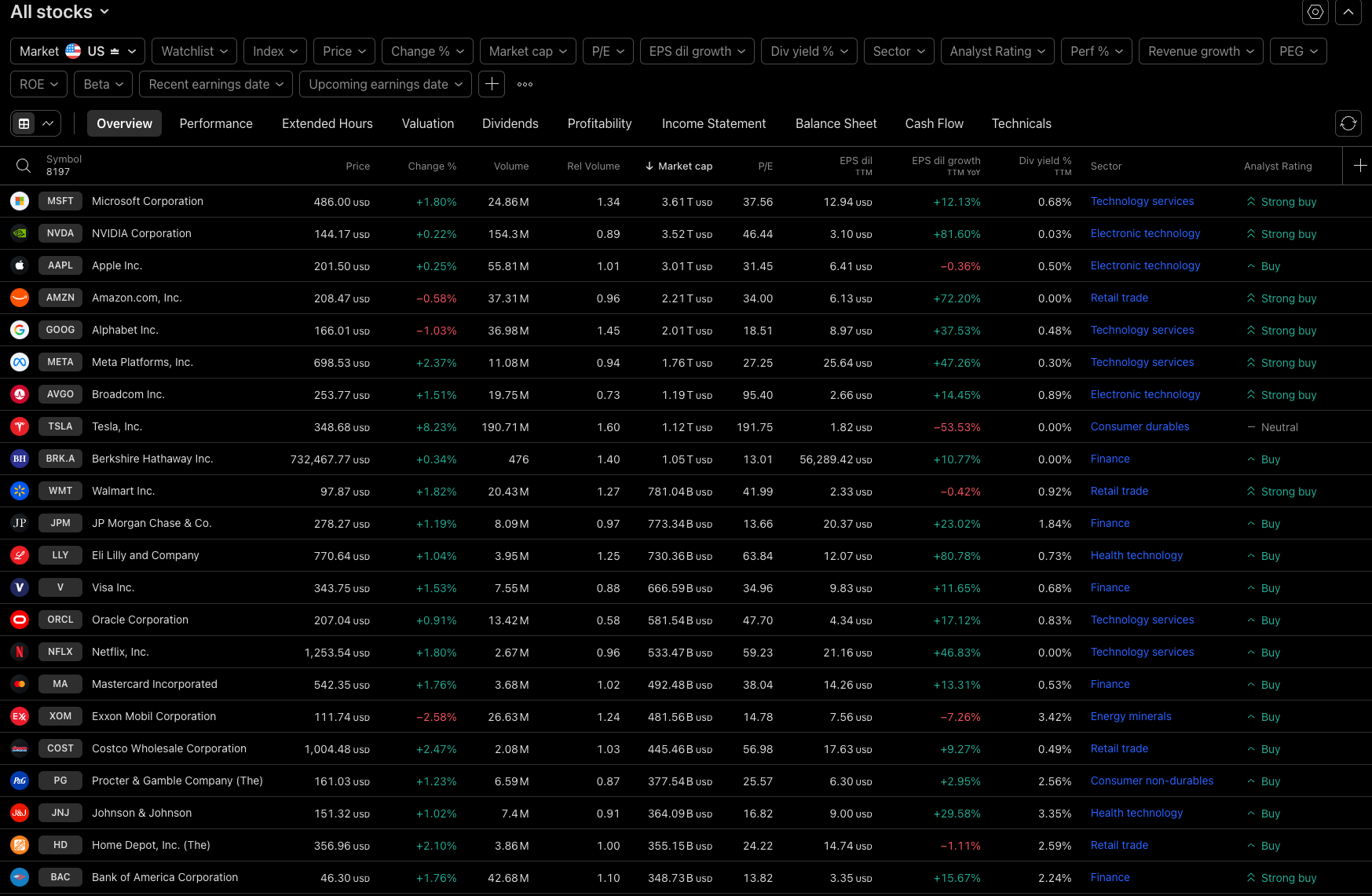

TradingView — The Charting-Focused Bloomberg Alternative

TradingView serves as a Bloomberg Terminal alternative primarily for technical analysis and charting, offering world-class visualization tools with global market coverage. The platform excels in chart-based analysis and has built a strong community of traders sharing ideas and strategies. While it provides excellent charting capabilities, TradingView's fundamental analysis tools remain limited compared to comprehensive Bloomberg alternatives.

As a Bloomberg alternative, TradingView offers exceptional value for technically-focused analysts and traders, with much lower pricing and better user experience than Bloomberg Terminal. However, teams requiring comprehensive fundamental analysis and institutional-grade research will find TradingView insufficient as a complete Bloomberg replacement.

Pros as Bloomberg Alternative

- World-class charting and technical analysis.

- Excellent user interface and experience.

- Very affordable pricing ($15-60/month).

- Strong community and idea sharing.

- Global multi-asset coverage.

- Great mobile experience.

Cons vs Comprehensive Bloomberg Alternatives

- Limited fundamental analysis capabilities.

- Weak screening and research tools.

- No AI-powered insights.

- Basic collaboration features.

- Focused on retail rather than institutional needs.

Bloomberg Terminal vs Alternatives: Cost Comparison

| Bloomberg Alternative | Monthly Cost | Annual Cost | Setup Fees | Savings vs Bloomberg |

|---|---|---|---|---|

| Bloomberg Terminal | $2,000 | $24,000 | $500 | — |

| Amsflow | $19 | $336 | $0 | 98.6% |

| Refinitiv Eikon | $1,833 | $22,000 | $1,000 | 8.3% |

| FactSet | $1,000 | $12,000 | $2,000 | 50% |

| YCharts | $300 | $3,600 | $0 | 85% |

| Koyfin | $39 | $468 | $0 | 98% |

| TradingView | $15 | $180 | $0 | 99.3% |

*Costs shown are per user. Enterprise pricing may vary. Bloomberg Terminal requires mandatory annual contracts.

The Best Bloomberg Terminal Alternative

After comprehensive analysis, Amsflow emerges as the superior Bloomberg Terminal alternative for modern investment teams. While Bloomberg Terminal pioneered financial data terminals, its 1980s interface, extreme costs, and lack of modern features make it increasingly obsolete for today's collaborative, mobile-first investment environment.

Amsflow delivers 90% of Bloomberg Terminal's core functionality through an AI-powered, intuitive platform at less than 2% of the cost. Unlike other Bloomberg alternatives that simply replicate Bloomberg's complexity with different interfaces, Amsflow reimagines financial analysis for the modern era—combining comprehensive global data with natural language AI, seamless team collaboration, and mobile-optimized experiences.

For teams ready to move beyond Bloomberg Terminal's limitations while maintaining institutional-quality analysis capabilities, Amsflow represents the clear choice among Bloomberg Terminal alternatives.

Transform your investment journey with Amsflow

Powerfull Intelligence, Smart Alerts, Advanced Screening & Portfolio Tracking. Never miss movements, discover opportunities, analyze global markets. All in One Sleek Platform.

Bloomberg Terminal Alternatives FAQ

Why are professionals switching from Bloomberg Terminal to alternatives?

Investment professionals are switching from Bloomberg Terminal due to its extreme cost ($24,000+ annually), outdated 1980s interface requiring extensive training, poor mobile functionality, and lack of modern features like AI-powered analysis and intuitive collaboration. Modern Bloomberg alternatives offer 80-98% cost savings while providing better user experiences and team productivity features.

Which Bloomberg Terminal alternative offers the best value?

Amsflow offers the best value among Bloomberg Terminal alternatives, providing comprehensive global market data, AI-powered analysis, team collaboration features, and institutional-quality tools at $19/month—a 98.6% cost reduction vs Bloomberg Terminal. Unlike other alternatives that compromise on features or user experience, Amsflow delivers modern functionality without Bloomberg's complexity or cost barriers.

Can Bloomberg Terminal alternatives match Bloomberg's data coverage?

Yes, leading Bloomberg Terminal alternatives like Amsflow, Refinitiv, and FactSet provide comprehensive global market data coverage across stocks, bonds, commodities, and forex. While Bloomberg Terminal has extensive historical archives, most alternatives offer sufficient historical data for practical analysis needs. Modern alternatives often provide better data visualization and easier access to the information professionals actually use daily.

What should I consider when switching from Bloomberg Terminal?

When switching from Bloomberg Terminal, consider: data coverage for your specific markets, integration with existing workflows, team collaboration needs, mobile access requirements, training time for your team, and total cost of ownership. Most Bloomberg alternatives offer free trials—test them with your actual workflows before committing. Focus on platforms that enhance rather than complicate your analysis process.

How long does it take to transition from Bloomberg Terminal to an alternative?

Transition time varies by alternative: Modern platforms like Amsflow enable immediate productivity with intuitive interfaces, while traditional alternatives like Refinitiv or FactSet may require weeks of training similar to Bloomberg. The key advantage of modern Bloomberg alternatives is dramatically reduced onboarding time—teams can typically achieve full productivity within days rather than months required for Bloomberg Terminal mastery.

Do Bloomberg Terminal alternatives offer real-time data?

Yes, most professional Bloomberg Terminal alternatives provide real-time market data. Platforms like Amsflow, Refinitiv, and FactSet offer comprehensive real-time feeds across global markets. Some alternatives offer different data tiers, with real-time access available on professional plans. The key difference is that modern alternatives present real-time data through more intuitive interfaces than Bloomberg Terminal's complex screens.

Which Bloomberg alternative is best for small investment firms?

Amsflow is ideal for small investment firms, offering institutional-quality analysis at startup-friendly pricing ($19/month vs Bloomberg's $2,000/month). Unlike enterprise-focused alternatives that require large minimum commitments, Amsflow provides comprehensive global data, AI-powered insights, and team collaboration features without contracts or setup fees. Small firms can access the same analytical capabilities as large institutions without Bloomberg's prohibitive costs.

Can I use multiple Bloomberg alternatives together?

Yes, many teams use complementary Bloomberg alternatives—for example, combining Amsflow for comprehensive analysis and team collaboration with TradingView for advanced charting, or using specialized tools for specific asset classes. This multi-platform approach often costs less than a single Bloomberg Terminal while providing better functionality. However, comprehensive alternatives like Amsflow may eliminate the need for multiple subscriptions.

What features should I prioritize in a Bloomberg Terminal alternative?

Prioritize: comprehensive global market data coverage, intuitive user interface requiring minimal training, real-time collaboration features for team workflows, mobile accessibility for global markets, AI-powered analysis and natural language search, flexible alert systems, competitive pricing without long-term contracts, and reliable customer support. The best Bloomberg alternatives excel in user experience while maintaining data quality and analytical depth.

Resources

Best Financial Analysis Platforms

Compare the best financial analysis platforms

Best SP Capital IQ Pro Alternatives

Compare the best SP Capital IQ Pro alternatives

Best Bloomberg Terminal Alternatives

Compare the best Bloomberg Terminal alternatives

Best YCharts Alternatives

Compare the best YCharts alternatives

Best Koyfin Alternatives

Compare the best Koyfin alternatives

Best Seeking Alpha Alternatives

Compare the best Seeking Alpha alternatives

Best Stock Screeners

Compare the best stock screeners

Best GuruFocus Alternatives

Compare the best GuruFocus alternatives

Best Simply Wall St Alternatives

Compare the best Simply Wall Street alternatives

Best FactSet Alternatives

Compare the best FactSet alternatives

Best TipRanks Alternatives

Compare the best TipRanks alternatives

Best MarketBeat Alternatives

Compare the best MarketBeat alternatives

Best Zacks Alternatives

Compare the best Zacks alternatives

Best TIKR Alternatives

Compare the best TIKR alternatives

Best Stock Rover Alternatives

Compare the best Stock Rover alternatives

Best Finviz Alternatives

Compare the best Finviz alternatives

Amsflow is for research and educational purposes only. Not financial advice. Amsflow doesn't recommend specific investments or securities. Market participation involves substantial risk, including potential loss of principal. Past performance doesn't guarantee future results. Amsflow doesn't offer fund/portfolio management services in any jurisdiction. Amsflow is a data platform only. Amsflow doesn't provide investment tips. Be cautious of imposters claiming to be Amsflow.