Best Zacks Alternatives — In-Depth Review & Comparison

Zacks Investment Research has been a long-standing provider of earnings estimates and stock rankings with a focus on earnings momentum. However, concerning user reviews (1.7/5 TrustScore), reported underperformance, limitations in global coverage, lack of AI integration, basic portfolio management, and absence of team collaboration features are driving investment professionals toward more reliable and comprehensive alternatives that deliver superior functionality and better investment outcomes.

The best Zacks alternatives combine research quality with proven performance,AI-powered insights, global market coverage, advanced portfolio management, andteam collaboration. We've evaluated how Amsflow compares against other Zacks alternatives including Seeking Alpha, TipRanks, Morningstar, YCharts, TIKR, and Stock Rover to help you find the perfect Zacks replacement for your investment workflow.

Zacks vs Leading Alternatives

| Zacks Alternative Features | Zacks Premium | Amsflow | Seeking Alpha | TipRanks | Morningstar | YCharts | TIKR |

|---|---|---|---|---|---|---|---|

| Modern UI/UX | Basic | Basic | Basic | Basic | Basic | ||

| AI-Powered Analysis | Basic | Basic | |||||

| Portfolio Monitoring | Basic | Basic | Basic | Basic | |||

| Screener | 600+ Items | 500+ Metrics and 8000+ Filters | Basic | Basic | Basic | 200+ Metrics | |

| Screener using natural language | |||||||

| Screener Inline Query Builder | |||||||

| Screener Global Coverage | US/Canada | US Only | Limited | ||||

| Returns Heat Map | |||||||

| Comprehensive Alerts | Limited | Fundamental, Technical, Portfolio, and Market | Limited | Limited | Limited | Limited | |

| Natural Language Search | |||||||

| World-class Portfolio Management | Basic | Basic | |||||

| Multi-Asset Portfolio Tracking | Limited | Limited | |||||

| Team Collaboration | Shared Watchlists, Real-time Team Discussions, Team Portfolios, Team Alerts, Team Screens & Teams Series | Basic | Basic | Basic | |||

| Correlation Analysis | Basic | Basic | |||||

| Technical Charting | Basic | Technical indicators, Multi-Panel Chart Layouts, In-line Chart Alerts & Drawing Tools | Basic | Basic | Basic | Basic | |

| Fundamental Analysis | |||||||

| Global Market Data | US/Canada | US Only | Limited | ||||

| Real-time Data | Limited | Limited | Limited | Limited | |||

| Stock Rankings/Ratings | Basic | Basic | |||||

| User Reviews/Trust Score | 1.7/5 | 4.5+/5 | 4.0/5 | 4.4/5 | 4.3/5 | 4.0/5 | 4.0/5 |

| Learning Curve | Medium | Low | Low | Low | Medium | Medium | Medium |

| Setup Time | Hours | Minutes | Minutes | Minutes | Hours | Hours | Hours |

| Annual Cost | $249+ | $228+ | $239+ | $396+ | $249+ | $3,600+ | $300+ |

| Starting Price for Individual users | $249/yr | $19/mo | $19.99/mo | $33/mo | $249/yr | $300/mo | $24.95/mo |

Why Investors Are Seeking Zacks Alternatives

While Zacks offers earnings-focused research and stock rankings, several critical issues are driving investment professionals toward more reliable and comprehensive alternatives:

Zacks Limitations

- Poor User Reviews: 1.7/5 TrustScore with consistent complaints about underperformance.

- Reported Losses: Users report significant losses following Zacks recommendations.

- Limited Global Coverage: Focused primarily on US/Canadian stocks.

- No AI Integration: Manual research without intelligent insights or natural language search.

- No Team Collaboration: Individual-focused platform lacking shared workflows.

- Basic Portfolio Management: Limited tracking without advanced analytics.

Advanced Alternative Benefits

- Proven Track Records: Higher user ratings (4.0+/5) with better performance reports.

- Reliable Research: Quality analysis with transparent methodologies and results.

- Global Market Coverage: Access to 100,000+ securities across worldwide markets.

- AI-Powered Insights: Natural language queries and automated analysis.

- Advanced Team Collaboration: Real-time sharing, discussions, and coordinated workflows.

- World-class Portfolio Management: Institutional-grade analytics and tracking.

Transform your investment journey with Amsflow

Powerfull Intelligence, Smart Alerts, Advanced Screening & Portfolio Tracking. Never miss movements, discover opportunities, analyze global markets. All in One Sleek Platform.

Amsflow — The Advanced Zacks Alternative

Amsflow stands out as the most comprehensive Zacks alternative, delivering superior research capabilities and investment tools while addressing Zacks' fundamental reliability issues. Unlike Zacks' concerning 1.7/5 user rating and reported underperformance, Amsflow maintains 4.5+ ratings with Lisa AI assistant that understands natural language queries like "Find undervalued dividend stocks with strong balance sheets in Europe" and instantly generates sophisticated analysis across 100,000+ global securities—far exceeding Zacks' US/Canada-only coverage.What makes Amsflow the superior Zacks alternative is its combination of proven reliability and world-class features that Zacks lacks entirely. While Zacks offers basic earnings-focused rankings with questionable performance records, Amsflow provides comprehensive multi-asset tracking across global markets (stocks, crypto, ETFs, funds), real-time data feeds, intelligent benchmarking against major indices, multiple position tracking per symbol with individual P&L calculations, and 24/7 portfolio monitoring with customizable threshold alerts. Combined with advanced team collaboration features including shared watchlists, real-time discussions, and coordinated alert systems, Amsflow transforms how investment teams work together—capabilities entirely absent from Zacks' individual-focused, underperforming platform.

Why Choose Amsflow Over Zacks

- Superior user ratings (4.5+/5) vs Zacks' concerning 1.7/5 TrustScore.

- Global market coverage (100,000+ securities) vs Zacks' US/Canada limitation.

- AI-native platform with Lisa assistant and natural language search.

- World-class Portfolio suite with multi-asset global tracking.

- Multiple position tracking per symbol with individual P&L calculations.

- Advanced team collaboration vs Zacks' individual-only focus.

- Comprehensive alert system with SMS, email, and webhook integrations.

- Advanced technical analysis with multi-panel layouts.

- Native mobile apps with seamless functionality.

- Better value ($19/mo vs $20.75/mo) with proven reliability.

Considerations

- Zacks has long history in earnings estimate aggregation.

- Zacks offers proprietary ranking system focused on earnings momentum.

- Some investors value Zacks' specific methodology despite poor reviews.

Seeking Alpha — The Community-Focused Zacks Alternative

Seeking Alpha serves as a popular Zacks alternative with significantly better user reviews (4.0/5 vs Zacks' 1.7/5), offering community insights and analyst research combined with screening tools and portfolio tracking. The platform provides access to thousands of analyst articles, earnings call transcripts, and crowdsourced opinions, making it attractive to investors seeking research depth with better reliability than Zacks' concerning performance record.

As a Zacks alternative, Seeking Alpha offers superior research content quality and community insights at similar pricing ($239/year vs $249/year) with better user satisfaction. However, it still lacks global coverage (US-focused like Zacks), AI-powered insights, advanced portfolio management, and team collaboration features that modern alternatives provide.

Pros as Zacks Alternative

- Much better user ratings (4.0/5 vs Zacks' 1.7/5).

- Similar pricing ($239/yr vs Zacks' $249/yr).

- Extensive analyst articles and research content.

- Community insights and crowdsourced opinions.

- Earnings call transcripts and alerts.

- Mobile app available.

Cons vs Comprehensive Zacks Alternatives

- US-focused coverage like Zacks' limitation.

- No AI features or natural language search.

- Limited screening vs advanced alternatives.

- Basic portfolio management tools.

- No advanced technical analysis.

- No team collaboration features.

TipRanks — The Analyst-Tracking Zacks Alternative

TipRanks serves as a strong Zacks alternative with significantly better user reviews (4.4/5 vs Zacks' 1.7/5), offering analyst tracking, smart scores, and portfolio management tools. The platform excels in tracking analyst performance and providing transparent ratings based on historical accuracy, making it more reliable than Zacks' concerning track record. TipRanks provides global coverage and AI-powered insights that exceed Zacks' US/Canada-only focus.

As a Zacks alternative, TipRanks offers superior analyst transparency, better user satisfaction, and more reliable performance tracking. However, at higher pricing ($396+/year vs Zacks' $249/year), it still lacks the comprehensive team collaboration and advanced portfolio management features that make Amsflow more compelling for professional teams.

Pros as Zacks Alternative

- Superior user ratings (4.4/5 vs Zacks' 1.7/5).

- Transparent analyst tracking with performance records.

- AI-powered smart scores and insights.

- Global market coverage vs Zacks' limitation.

- Strong portfolio management tools.

- Comprehensive alerts and monitoring.

Cons vs Modern Zacks Alternatives

- Higher pricing ($396+/yr vs Zacks' $249/yr).

- No advanced team collaboration features.

- Limited screening vs comprehensive alternatives.

- No natural language search capabilities.

- Portfolio management not as advanced as Amsflow.

- Analyst-focused rather than comprehensive analysis.

Morningstar — The Research-Focused Zacks Alternative

Morningstar serves as a well-established Zacks alternative with better user reviews (4.3/5 vs Zacks' 1.7/5), offering comprehensive fundamental research, proprietary ratings, and extensive fund/ETF analysis. The platform provides deep fundamental research with transparent methodologies and better reliability than Zacks' concerning performance record, making it attractive to long-term investors seeking quality analysis at similar pricing ($249/year).

As a Zacks alternative, Morningstar offers superior research quality, better fund/ETF coverage, and more reliable ratings. However, it still lacks AI integration, advanced technical analysis, real-time data feeds, and team collaboration features while maintaining an older interface design that hasn't evolved with modern platforms.

Pros as Zacks Alternative

- Better user ratings (4.3/5 vs Zacks' 1.7/5).

- Similar pricing ($249/yr like Zacks).

- Comprehensive fundamental research quality.

- Strong fund and ETF analysis coverage.

- Global market coverage.

- Transparent rating methodologies.

Cons vs Modern Zacks Alternatives

- Outdated interface and user experience.

- No AI features or natural language search.

- Limited technical analysis capabilities.

- No real-time data feeds.

- Basic portfolio management tools.

- No team collaboration features.

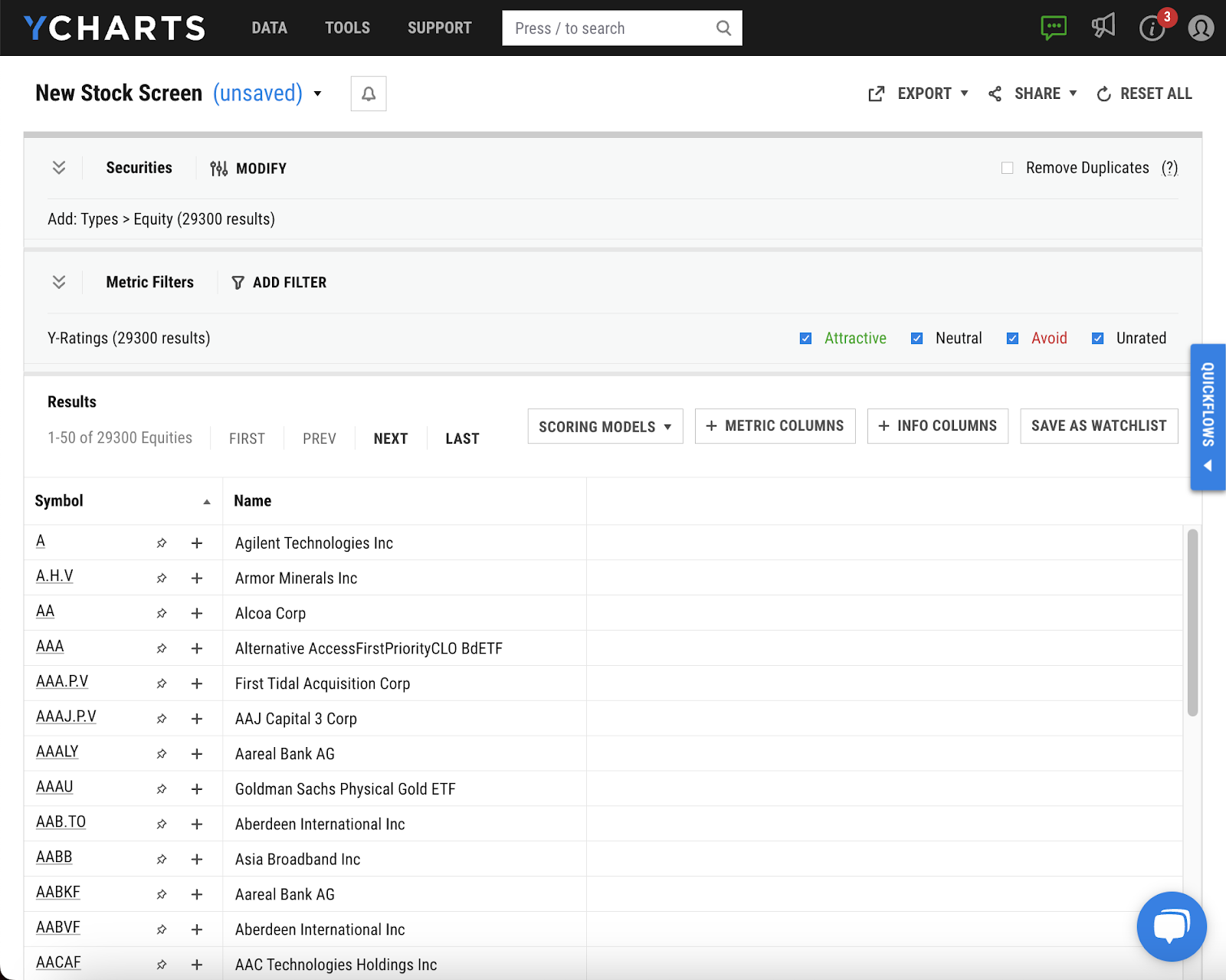

YCharts — The Professional Zacks Alternative

YCharts serves as a Zacks alternative focused on professional-grade fundamental data and presentation-ready charting, offering deeper data coverage and better user reviews (4.0/5 vs Zacks' 1.7/5). The platform excels in creating polished reports and charts for client presentations, providing more comprehensive fundamental analysis than Zacks with extensive historical data and advisor-focused workflows at significantly higher pricing.

As a Zacks alternative, YCharts provides superior fundamental data depth and professional reporting tools but comes with dramatically higher pricing ($3,600/year vs Zacks' $249/year) and an outdated interface. The platform offers better reliability than Zacks but lacks AI integration, real-time collaboration, and modern user experience.

Pros as Zacks Alternative

- Better user ratings (4.0/5 vs Zacks' 1.7/5).

- More extensive fundamental data coverage.

- Professional presentation capabilities.

- Strong Excel integration for data export.

- Comprehensive company analysis tools.

Cons vs Accessible Zacks Alternatives

- Much higher cost ($3,600/yr vs Zacks' $249/yr).

- Outdated interface and user experience.

- No AI features or natural language search.

- Limited real-time data capabilities.

- Poor mobile functionality.

- Enterprise-focused pricing vs retail accessibility.

TIKR — The Global Zacks Alternative

TIKR serves as a Zacks alternative with global market coverage and better user reviews (4.0/5 vs Zacks' 1.7/5), offering institutional-grade data from S&P Global across 100,000+ stocks in 92 countries—vastly exceeding Zacks' US/Canada-only coverage. The platform provides strong fundamental analysis capabilities with 200+ metrics and comprehensive screening tools, making it more reliable and globally accessible than Zacks' limited offering.

As a Zacks alternative, TIKR offers superior global coverage, better data quality from S&P Global, and more satisfied users at similar pricing ($300/year vs Zacks' $249/year). However, it still lacks AI integration, team collaboration, advanced portfolio management, and mobile apps that modern alternatives provide.

Pros as Zacks Alternative

- Better user ratings (4.0/5 vs Zacks' 1.7/5).

- Global coverage (100,000+ stocks) vs Zacks' US/Canada.

- Similar pricing ($300/yr vs Zacks' $249/yr).

- S&P Global institutional-grade data.

- Strong fundamental analysis tools.

- Superinvestor portfolio tracking.

Cons vs Advanced Zacks Alternatives

- No AI features or natural language search.

- No team collaboration features.

- Limited technical analysis capabilities.

- Web-only access without mobile apps.

- No real-time data feeds.

- Basic portfolio management tools.

Stock Rover — The Metric-Heavy Zacks Alternative

Stock Rover serves as a Zacks alternative focused on comprehensive fundamental analysis with 700+ metrics, offering significantly deeper screening capabilities and better user reviews (4.0+/5 vs Zacks' 1.7/5). The platform provides extensive portfolio management tools and advanced analytics that exceed Zacks' basic offerings, making it attractive to fundamental investors seeking more sophisticated analytical tools at much lower pricing ($96/year vs Zacks' $249/year).

As a Zacks alternative, Stock Rover offers superior fundamental depth, better portfolio management, and lower pricing but shares Zacks' limitation of US-only coverage without global market access. The platform also lacks mobile apps, AI integration, and team collaboration features.

Pros as Zacks Alternative

- Better user ratings (4.0+/5 vs Zacks' 1.7/5).

- Much lower cost ($96/yr vs Zacks' $249/yr).

- 700+ metrics for deep fundamental analysis.

- Advanced portfolio management tools.

- Comprehensive screening capabilities.

Cons vs Global Zacks Alternatives

- US-only coverage like Zacks' limitation.

- No mobile app, web-only access.

- No AI integration or natural language search.

- No team collaboration features.

- No real-time data feeds.

- Limited to fundamental analysis focus.

The Best Zacks Alternative for Modern Investors

After comprehensive analysis, Amsflow emerges as the superior Zacks alternative for investment professionals seeking reliable research and comprehensive analysis capabilities. While Zacks offers earnings-focused rankings, its concerning 1.7/5 user rating, reported underperformance with subscriber losses, limitations in global coverage, lack of AI integration, and absence of team collaboration make it insufficient and unreliable for today's demanding investment workflows.

Amsflow delivers proven reliability with 4.5+ user ratings while addressing every Zacks limitation: global market coverage across 100,000+ securities vs Zacks' US/Canada-only focus, AI-powered insights with natural language search vs manual research, world-class portfolio management with multi-asset tracking vs basic tools, comprehensive team collaboration features vs individual-only focus, and advanced technical analysis with native mobile apps vs limited functionality. At competitive pricing ($19/month vs Zacks' $20.75/month), Amsflow provides dramatically superior global functionality with proven user satisfaction and better investment outcomes.

For investment teams ready to move beyond Zacks' reliability concerns and geographic limitations while accessing modern AI-powered analysis and team workflows, Amsflow represents the clear choice among Zacks alternatives.

Transform your investment journey with Amsflow

Powerfull Intelligence, Smart Alerts, Advanced Screening & Portfolio Tracking. Never miss movements, discover opportunities, analyze global markets. All in One Sleek Platform.

Zacks Alternatives FAQ

Why are investors looking for Zacks alternatives?

Investors are seeking Zacks alternatives due to its concerning 1.7/5 TrustScore with consistent user complaints about underperformance and losses, US/Canada-only market coverage without global access, lack of AI integration for automated analysis, no team collaboration features, basic portfolio management, and outdated interface. While Zacks offers earnings-focused rankings, modern investment professionals need proven reliability, global coverage, AI-powered insights, and team workflows that Zacks cannot provide with its poor track record.

Which Zacks alternative offers the best combination of reliability and features?

Amsflow offers the best combination of proven reliability and comprehensive features among Zacks alternatives, providing superior user ratings (4.5+/5 vs Zacks' 1.7/5), global market coverage (100,000+ securities vs Zacks' US/Canada-only), AI-powered analysis, world-class portfolio management, and comprehensive team collaboration at similar pricing ($19/month vs Zacks' $20.75/month). Unlike other alternatives that may improve on some aspects, Amsflow addresses every Zacks limitation while providing proven user satisfaction.

Are Zacks alternatives more reliable than Zacks?

Yes, leading Zacks alternatives demonstrate significantly better reliability. While Zacks has a concerning 1.7/5 TrustScore with reported subscriber losses and underperformance, alternatives like Amsflow (4.5+/5), TipRanks (4.4/5), Morningstar (4.3/5), and Seeking Alpha (4.0/5) all show superior user satisfaction and more transparent methodologies. These alternatives provide better track records, more reliable research, and greater user confidence compared to Zacks' troubling performance history.

What should I consider when switching from Zacks to an alternative?

When switching from Zacks, prioritize: proven reliability with strong user reviews (avoid platforms with Zacks' 1.7/5 issues), global market coverage for international investing, AI-powered analysis capabilities for automated insights, team collaboration tools for workflow efficiency, advanced portfolio management depth, transparent research methodologies, mobile app availability, and total value proposition. Most Zacks alternatives offer free trials—test them with actual workflows to verify improved reliability and performance beyond Zacks' concerning track record.

How do AI-powered Zacks alternatives compare to Zacks' manual rankings?

AI-powered Zacks alternatives like Amsflow fundamentally transform investment research by understanding natural language queries, automatically generating sophisticated analysis, and providing intelligent insights without relying on potentially flawed ranking systems. While Zacks requires users to trust proprietary rankings that users report as unreliable (1.7/5 rating), AI alternatives translate human intent into comprehensive multi-factor analysis instantly, reducing research time while improving analytical depth and reliability beyond Zacks' questionable methodology.

Do Zacks alternatives offer better global market coverage?

Yes, leading Zacks alternatives like Amsflow, TIKR, TipRanks, and Morningstar offer significantly better global market coverage. While Zacks is limited to US and Canadian stocks only, Amsflow provides access to 100,000+ securities across global markets including Europe, Asia, and emerging markets. This comprehensive global coverage is essential for diversified portfolios and international investment strategies that Zacks' US/Canada-only limitation prevents, especially given Zacks' poor performance even within its limited geography.

Which Zacks alternative is best for professional investment teams?

Amsflow excels for professional investment teams, offering scalable features that Zacks entirely lacks. While Zacks provides only individual-focused rankings with poor reliability, Amsflow delivers comprehensive team collaboration with real-time discussions, shared watchlists and alerts, coordinated research workflows, team-level portfolio management, and integrated communication systems. Combined with superior reliability (4.5+/5 vs Zacks' 1.7/5), global coverage, and AI-powered insights at similar pricing, Amsflow provides institutional-quality capabilities that professional teams require.

Can I use multiple Zacks alternatives together?

While some investors combine multiple platforms—for example, using Seeking Alpha for community insights alongside TipRanks for analyst tracking—comprehensive alternatives like Amsflow often eliminate the need for multiple subscriptions. Amsflow provides global screening, AI-powered analysis, comprehensive fundamental and technical research, real-time data, world-class portfolio management, and team collaboration in one integrated platform, simplifying workflows while reducing costs and complexity compared to managing multiple tools or relying on Zacks' unreliable single-focus approach.

What features should I prioritize in a Zacks alternative?

Prioritize: proven reliability with strong user reviews (4.0+/5) vs Zacks' concerning 1.7/5, global market coverage beyond US/Canada, transparent research methodologies with verifiable track records, AI-powered analysis and natural language search for efficiency, comprehensive portfolio management with multi-asset tracking, real-time team collaboration features, mobile optimization for market monitoring, advanced technical analysis capabilities, competitive pricing, and intuitive user experience. The best Zacks alternatives provide superior reliability and functionality while addressing Zacks' fundamental performance and coverage limitations.

Resources

Best Financial Analysis Platforms

Compare the best financial analysis platforms

Best SP Capital IQ Pro Alternatives

Compare the best SP Capital IQ Pro alternatives

Best Bloomberg Terminal Alternatives

Compare the best Bloomberg Terminal alternatives

Best YCharts Alternatives

Compare the best YCharts alternatives

Best Koyfin Alternatives

Compare the best Koyfin alternatives

Best Seeking Alpha Alternatives

Compare the best Seeking Alpha alternatives

Best Stock Screeners

Compare the best stock screeners

Best GuruFocus Alternatives

Compare the best GuruFocus alternatives

Best Simply Wall St Alternatives

Compare the best Simply Wall Street alternatives

Best FactSet Alternatives

Compare the best FactSet alternatives

Best TipRanks Alternatives

Compare the best TipRanks alternatives

Best MarketBeat Alternatives

Compare the best MarketBeat alternatives

Best Zacks Alternatives

Compare the best Zacks alternatives

Best TIKR Alternatives

Compare the best TIKR alternatives

Best Stock Rover Alternatives

Compare the best Stock Rover alternatives

Best Finviz Alternatives

Compare the best Finviz alternatives

Amsflow is for research and educational purposes only. Not financial advice. Amsflow doesn't recommend specific investments or securities. Market participation involves substantial risk, including potential loss of principal. Past performance doesn't guarantee future results. Amsflow doesn't offer fund/portfolio management services in any jurisdiction. Amsflow is a data platform only. Amsflow doesn't provide investment tips. Be cautious of imposters claiming to be Amsflow.