Best FactSet Alternatives — In-Depth Review & Comparison

FactSet has served institutional investors with comprehensive financial data and analytics, but its extreme enterprise pricing ($12,000-$45,000+ annually per user), complex setup requiring extensive IT resources, steep learning curve, lack of AI-powered insights, and enterprise-focused complexity are driving investment professionals toward more accessible alternatives. Today's market demands more than just data depth—teams need intuitive interfaces, AI-driven analysis, and world-class portfolio management without enterprise barriers.

The best FactSet alternatives combine institutional-quality data with modern user interfaces,AI-powered insights, accessible pricing, and world-class portfolio management. We've evaluated how Amsflow compares against other FactSet alternatives including Bloomberg Terminal, Refinitiv Eikon, S&P Capital IQ, YCharts, Koyfin, and TradingView to help you find the perfect FactSet replacement for modern investment workflows.

FactSet vs Leading Alternatives

| FactSet Alternative Features | FactSet | Amsflow | Bloomberg Terminal | Refinitiv Eikon | S&P Capital IQ | YCharts | Koyfin |

|---|---|---|---|---|---|---|---|

| Modern UI/UX | Basic | Basic | Basic | ||||

| AI-Powered Analysis | |||||||

| Portfolio Monitoring | Basic | Basic | |||||

| Screener | Basic | 500+ Metrics and 8000+ Filters | Basic | Basic | Basic | Basic | Basic |

| Screener using natural language | |||||||

| Screener Inline Query Builder | |||||||

| Screener Global Coverage | Limited | Limited | Limited | Limited | Limited | Limited | |

| Returns Heat Map | |||||||

| Comprehensive Alerts | Limited | Fundamental, Technical, Portfolio, and Market | Limited | Limited | Limited | Limited | Limited |

| Natural Language Search | |||||||

| World-class Portfolio Management | Basic | ||||||

| Multi-Asset Portfolio Tracking | Limited | Limited | Limited | ||||

| Team Collaboration | Basic | Shared Watchlists, Real-time Team Discussions, Team Portfolios, Team Alerts, Team Screens & Teams Series | Basic | Basic | Basic | Basic | Basic |

| Correlation Analysis | |||||||

| Technical Charting | Basic | Technical indicators, Multi-Panel Chart Layouts, In-line Chart Alerts & Drawing Tools | Basic | Basic | Basic | Basic | Basic |

| Fundamental Analysis | |||||||

| Institutional-Quality Data | |||||||

| Global Market Data | Limited | ||||||

| Learning Curve | High | Low | Very High | High | Very High | Medium | Medium |

| Setup Time | Days | Minutes | Weeks | Days | Weeks | Hours | Hours |

| Enterprise Cost Per Seat (Annual) | $12,000-$45,000 | $4,560+ | $24,000+ | $22,000+ | $10,000+ | $3,600+ | $948+ |

| Starting Price for Individual users | $19/mo | $300/mo | Freemium |

Why Investment Teams Are Seeking FactSet Alternatives

While FactSet offers comprehensive financial data and analytics, several critical limitations are driving investment professionals toward more modern alternatives:

FactSet Limitations

- Extreme Enterprise Pricing: $12,000-$45,000+ per user annually with mandatory multi-year commitments.

- Complex Setup Requirements: Requires extensive IT resources and days/weeks of implementation.

- Steep Learning Curve: High complexity requiring significant training investment for productivity.

- No AI Integration: Purely manual navigation without intelligent insights or natural language capabilities.

- Enterprise-Focused Complexity: Designed for large institutions, creating barriers for smaller teams.

- Basic Portfolio Tools: Limited tracking without advanced analytics or multi-position support.

- Competitive Headwinds: Facing budget constraints and losing contracts to more innovative competitors.

Modern Alternative Benefits

- Accessible Pricing: 70-99% cost savings vs FactSet without sacrificing institutional-quality data.

- Instant Setup: Minutes to productivity without IT requirements or complex implementation.

- Zero Learning Curve: Intuitive interfaces requiring minimal training for immediate effectiveness.

- AI-Powered Insights: Natural language queries and automated analysis for faster research.

- User-Friendly Design: Modern interfaces accessible to teams of all sizes.

- World-class Portfolio Management: Multi-asset tracking with institutional-grade analytics.

- Innovation-Focused: Modern platforms prioritizing user experience and continuous improvement.

Transform your investment journey with Amsflow

Powerfull Intelligence, Smart Alerts, Advanced Screening & Portfolio Tracking. Never miss movements, discover opportunities, analyze global markets. All in One Sleek Platform.

Amsflow — The Modern FactSet Alternative

Amsflow stands out as the most comprehensive FactSet alternative, delivering institutional-quality financial analysis without FactSet's enterprise barriers and extreme costs. Unlike FactSet's complex setup requiring extensive IT resources and days of implementation, Amsflow's Lisa AI assistant provides instant productivity through natural language queries like "Find undervalued companies with strong ROE and improving margins" that instantly generate sophisticated analysis across 100,000+ global securities without training requirements or setup complexity.What makes Amsflow the superior FactSet alternative is its world-class Portfolio Management suite—engineered with institutional-grade analytics that FactSet's basic tools simply cannot match. While FactSet offers limited portfolio tracking, Amsflow provides comprehensive multi-asset tracking (stocks, crypto, ETFs, funds), intelligent benchmarking against major indices, multiple position tracking per symbol with individual P&L calculations, and 24/7 portfolio monitoring with customizable threshold alerts. Combined with advanced team collaboration features including shared watchlists, real-time discussions, team portfolios, and coordinated alert systems, Amsflow transforms how investment teams work together without enterprise complexity.

Why Choose Amsflow Over FactSet

- 99% cost reduction vs FactSet ($336/year vs $12,000-$45,000/year).

- World-class Portfolio suite with multi-asset tracking and institutional-grade analytics.

- AI-native platform with Lisa assistant eliminating FactSet's complex workflows.

- Zero setup time vs FactSet's days/weeks of IT implementation.

- Instant productivity vs FactSet's steep learning curve and training requirements.

- Modern, intuitive interface vs FactSet's enterprise complexity.

- Multiple position tracking per symbol with individual P&L calculations.

- Comprehensive team collaboration features.

- Natural language search vs FactSet's manual navigation.

- No multi-year commitments or enterprise barriers to entry.

Considerations

- Newer platform with fewer legacy enterprise integrations.

- Different approach than FactSet's enterprise-focused workflows.

- Streamlined for accessibility vs FactSet's comprehensive but complex offerings.

Bloomberg Terminal — The Premium FactSet Alternative

Bloomberg Terminal serves as the market-leading FactSet alternative, offering unparalleled data breadth and real-time market coverage. While Bloomberg provides superior real-time capabilities and more comprehensive fixed income coverage than FactSet, it comes with even higher costs ($24,000+ annually vs FactSet's $12,000-$45,000), a 1980s interface that rivals FactSet's complexity, and similarly steep learning curves requiring months of training.

As a FactSet alternative, Bloomberg Terminal offers better real-time data and broader market coverage but maintains the same fundamental problems—prohibitive costs, archaic interfaces, extensive training requirements, and lack of modern features like AI integration that drive teams toward truly accessible solutions.

Pros as FactSet Alternative

- Superior real-time data vs FactSet's analytical focus.

- More comprehensive fixed income and derivatives coverage.

- Industry-standard messaging and networking capabilities.

- Extensive historical data archives.

- Better news and research content integration.

Cons vs Modern Alternatives

- Even higher cost than FactSet ($24,000+ vs $12,000-$45,000).

- 1980s interface equally complex as FactSet's design.

- Requires months of training similar to FactSet complexity.

- No AI integration or natural language capabilities.

- Poor mobile experience limiting accessibility.

- Complex setup and implementation requirements.

Refinitiv Eikon — The Data-Intensive FactSet Alternative

Refinitiv Eikon (LSEG Workspace) serves as a direct FactSet competitor offering extensive global market data and analytics with better Excel integration. The platform provides comprehensive research content, customizable analytics, and real-time capabilities that exceed FactSet's primarily analytical focus. However, Refinitiv comes with even higher pricing ($22,000+ annually) and similar enterprise complexity that creates barriers to entry.

As a FactSet alternative, Refinitiv Eikon offers comparable data depth with somewhat better real-time capabilities and Excel workflow integration. However, it maintains similar pricing levels and enterprise-focused complexity while lacking the AI-powered insights and modern user experience that today's investment teams demand.

Pros as FactSet Alternative

- Comprehensive global market data matching FactSet's coverage.

- Better Excel integration than FactSet's workflows.

- Superior real-time capabilities and news content.

- Extensive API access and customization options.

- Strong fixed income and derivatives coverage.

Cons vs Accessible Alternatives

- Similar extreme pricing ($22,000+ vs FactSet's $12,000-$45,000).

- Complex, fragmented interface across multiple modules.

- Requires extensive training similar to FactSet.

- No AI-powered insights or natural language capabilities.

- Limited mobile functionality compared to modern alternatives.

- Enterprise complexity vs user-friendly modern platforms.

S&P Capital IQ — The Data-Heavy FactSet Alternative

S&P Capital IQ positions itself as a somewhat more affordable FactSet alternative ($10,000+ annually vs FactSet's $12,000-$45,000), offering extensive fundamental data and company research. The platform provides comprehensive screening capabilities and detailed financial analysis, making it attractive to teams seeking FactSet-like depth at modestly lower pricing. However, Capital IQ suffers from a severely outdated interface from the early 2000s.

As a FactSet alternative, S&P Capital IQ offers comprehensive data depth at marginally lower cost but fails dramatically in user experience. The platform's archaic interface, convoluted navigation, and lack of modern features like AI integration make it feel antiquated compared to FactSet's somewhat more modern design, while maintaining similar enterprise barriers and complexity.

Pros as FactSet Alternative

- Somewhat lower cost than FactSet ($10,000+ vs $12,000-$45,000).

- Extensive fundamental data and company research.

- Strong screening and filtering capabilities.

- Comprehensive industry and sector analysis.

- Established data quality and market presence.

Cons vs Modern Alternatives

- Severely outdated interface from early 2000s.

- Still expensive enterprise pricing ($10,000+ annually).

- Extremely poor user experience and navigation.

- No AI features or modern search capabilities.

- Minimal collaboration and team features.

- Poor mobile experience and accessibility.

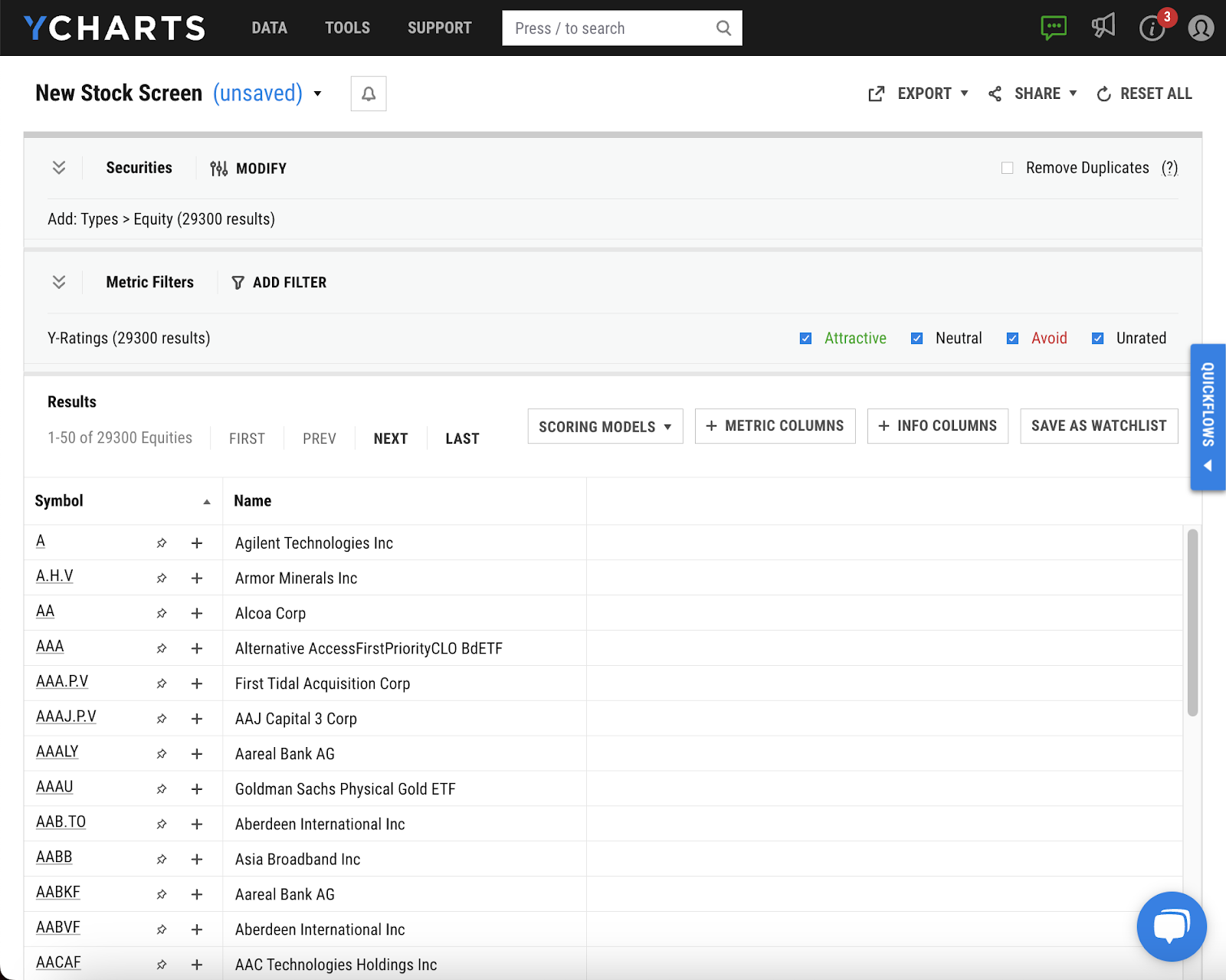

YCharts — The Advisor-Focused FactSet Alternative

YCharts serves as a more accessible FactSet alternative targeting financial advisors and smaller investment firms with extensive fundamental data at dramatically lower pricing ($3,600/year vs FactSet's $12,000-$45,000). The platform provides comprehensive data coverage, presentation-ready charting, and professional tools without FactSet's enterprise barriers and setup complexity. However, YCharts suffers from an outdated interface and limited real-time capabilities.

As a FactSet alternative, YCharts offers 70-90% cost savings with better accessibility for smaller teams. However, the platform's dated user experience, limited real-time data, and lack of AI-powered insights make it feel like a budget version of FactSet rather than a modern alternative that enhances workflows.

Pros as FactSet Alternative

- 70-90% cost savings vs FactSet ($300/mo vs $1,000-$3,750/mo).

- More accessible for smaller firms and advisors.

- Comprehensive fundamental data coverage.

- Better presentation and charting capabilities.

- No complex setup or IT requirements.

Cons vs Modern Alternatives

- Outdated interface and user experience.

- Still expensive for individual users ($300+/month).

- Limited real-time data capabilities.

- No AI features or natural language search.

- Basic portfolio management compared to Amsflow.

- Poor mobile experience vs modern platforms.

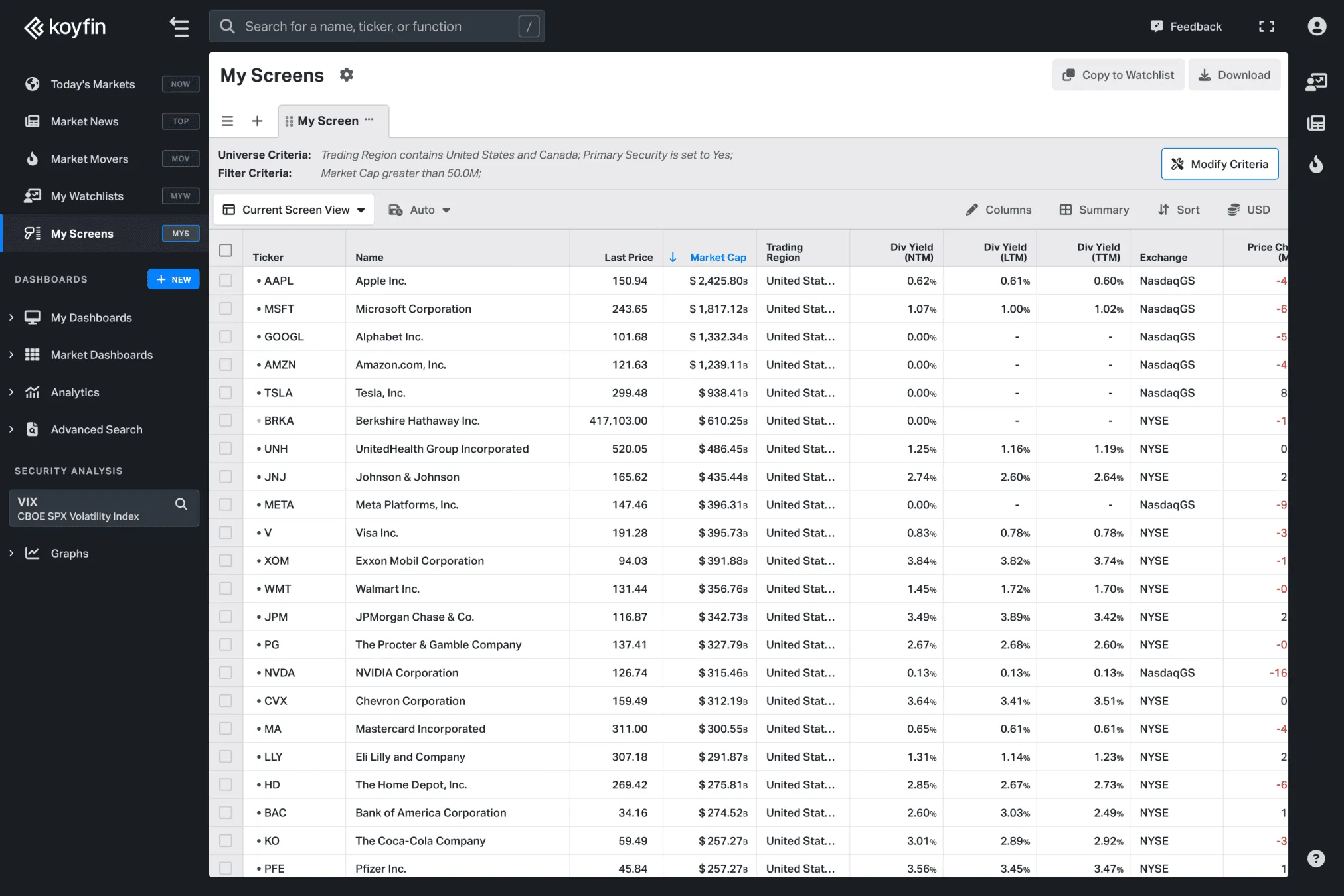

Koyfin — The Budget FactSet Alternative

Koyfin represents one of the most affordable FactSet alternatives, offering decent fundamental data coverage and modern interface design at a fraction of FactSet's enterprise pricing ($468/year vs FactSet's $12,000-$45,000). The platform provides solid global market coverage with cleaner visual design than FactSet's interface, making it attractive to individual investors and smaller teams seeking fundamental analysis without enterprise-level costs or complexity.

As a FactSet alternative, Koyfin succeeds in providing accessible fundamental analysis at 95-97% cost savings with better value proposition. However, it lacks the comprehensive data depth, advanced analytics, institutional-grade features, and professional tools that make FactSet attractive to larger investment teams.

Pros as FactSet Alternative

- 95-97% cost savings vs FactSet ($39/mo vs $1,000-$3,750/mo).

- Much cleaner, more modern interface than FactSet.

- Good fundamental data and macro analysis.

- Free tier available for basic usage.

- Lower learning curve than FactSet complexity.

- No setup requirements or IT involvement needed.

Cons vs Comprehensive Alternatives

- Limited data depth vs FactSet's comprehensive coverage.

- No AI features or natural language search.

- Basic portfolio management capabilities.

- Limited team collaboration features.

- Less comprehensive analytics than FactSet.

- Fewer institutional-grade research tools.

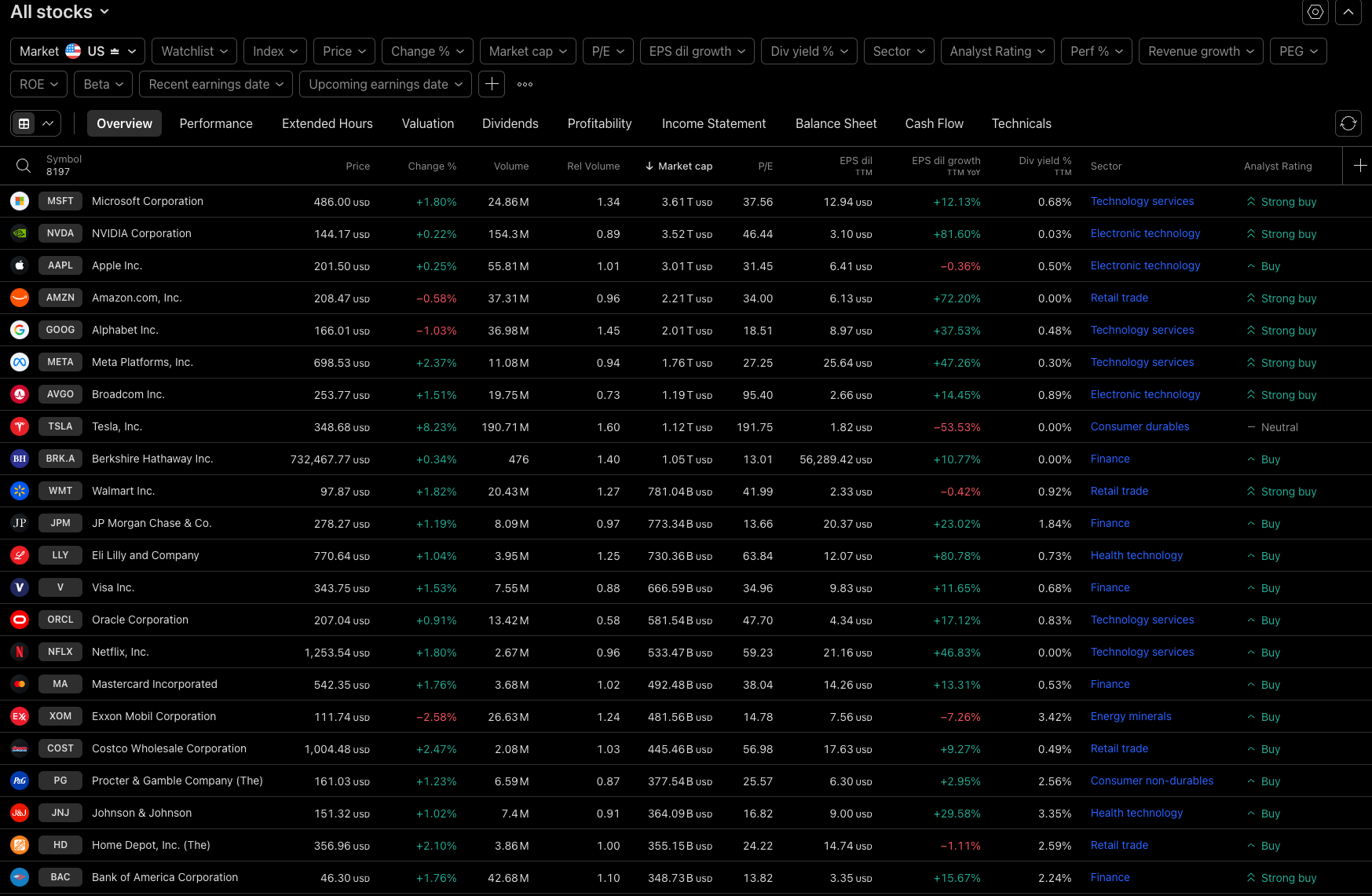

TradingView — The Charting-Focused FactSet Alternative

TradingView serves as a partial FactSet alternative emphasizing technical analysis and charting over FactSet's fundamental-focused approach. The platform provides world-class visualization tools, global market coverage, and excellent user experience at dramatically lower pricing than FactSet ($180-720/year vs FactSet's $12,000-$45,000). However, it lacks the comprehensive fundamental analysis and institutional-grade research tools that make FactSet attractive to fundamental investors.

As a FactSet alternative, TradingView offers exceptional charting capabilities and modern user experience at 98-99% cost savings. However, it provides limited fundamental analysis, minimal portfolio management features, and lacks the comprehensive research depth that teams requiring FactSet-level fundamental analysis need as complete replacement.

Pros as FactSet Alternative

- 98-99% cost savings vs FactSet ($15-60/mo vs $1,000-$3,750/mo).

- Superior charting and technical analysis tools.

- Excellent modern user interface and experience.

- Strong community and idea sharing features.

- Great mobile experience and accessibility.

- Global multi-asset market coverage.

Cons vs Comprehensive Alternatives

- Limited fundamental analysis vs FactSet's depth.

- Minimal screening and research functionality.

- Basic financial data compared to FactSet's coverage.

- No AI-powered fundamental insights.

- Limited institutional-grade research tools.

- Not suitable as complete FactSet replacement for fundamental investors.

The Best FactSet Alternative for Modern Investment Teams

After comprehensive analysis, Amsflow emerges as the superior FactSet alternative for investment teams seeking institutional-quality financial analysis without FactSet's enterprise barriers and extreme costs. While FactSet offers comprehensive financial data and analytics, its $12,000-$45,000+ annual pricing per user, complex setup requiring extensive IT resources, steep learning curve, lack of AI-powered insights, and enterprise-focused complexity make it increasingly inaccessible for modern investment teams who demand efficiency and intuitive experiences.

Amsflow delivers the institutional-quality analysis capabilities that investment professionals require—extensive global data, detailed screening with 500+ metrics, powerful analytics, and comprehensive research tools—while solving every major limitation that creates barriers with FactSet. Unlike FactSet's complex setup requiring days/weeks of IT implementation, Amsflow provides instant productivity from day one. Unlike FactSet's steep learning curve requiring significant training investment, Amsflow's intuitive, AI-powered platform enables immediate effectiveness through natural language queries. Unlike FactSet's basic portfolio tracking, Amsflow offers world-class Portfolio Management with multi-asset tracking, multiple position support, intelligent benchmarking, and real-time monitoring. At 99% cost savings ($336/year vs $12,000-$45,000/year) with no setup time or training requirements, Amsflow transforms investment research without enterprise barriers.

For investment teams ready to move beyond FactSet's enterprise complexity and prohibitive costs while maintaining—and exceeding—analytical capabilities, Amsflow represents the clear choice among FactSet alternatives.

Transform your investment journey with Amsflow

Powerfull Intelligence, Smart Alerts, Advanced Screening & Portfolio Tracking. Never miss movements, discover opportunities, analyze global markets. All in One Sleek Platform.

FactSet Alternatives FAQ

Why are investment teams switching from FactSet to alternatives?

Investment teams are switching from FactSet due to extreme enterprise pricing ($12,000-$45,000+ per user annually), complex setup requiring extensive IT resources and days/weeks of implementation, steep learning curve requiring significant training investment, lack of AI-powered analysis tools, enterprise-focused complexity creating barriers for smaller teams, and competitive pressures as FactSet faces budget constraints. Modern FactSet alternatives offer 70-99% cost savings while providing superior user experiences, AI integration, and instant productivity.

Which FactSet alternative offers the best combination of features and value?

Amsflow offers the best combination of features and value among FactSet alternatives, providing institutional-quality data, AI-powered analysis, world-class portfolio management, and comprehensive team collaboration at $19/month—99% less than FactSet's $12,000-$45,000/year pricing. Unlike FactSet's complex setup requiring IT resources and training, Amsflow delivers instant productivity with intuitive modern interface requiring zero setup time and no learning curve.

Can FactSet alternatives match FactSet's data coverage and quality?

Yes, leading FactSet alternatives like Amsflow provide comprehensive institutional-quality data coverage that matches FactSet's capabilities for most investment analysis needs. Amsflow covers 100,000+ global securities with extensive fundamental, technical, and market data, offering equivalent analytical depth through dramatically more intuitive interface. Modern alternatives often provide better data visualization, easier access to insights, and more powerful AI-driven analysis than FactSet's manual workflows.

What should I consider when switching from FactSet to an alternative?

When switching from FactSet, consider: data coverage for your specific needs, cost savings opportunity (70-99% potential reduction), setup time elimination (instant vs days/weeks), learning curve removal (zero training vs significant investment), AI-powered analysis capabilities for efficiency gains, advanced portfolio management features, team collaboration tools, mobile accessibility, and total value proposition. Most alternatives offer free trials—test them to experience dramatic improvements in user experience and cost efficiency over FactSet's enterprise complexity.

How long does it take to transition from FactSet to an alternative?

Transition time varies by alternative: Modern platforms like Amsflow enable immediate productivity with intuitive interfaces requiring zero setup and no training, dramatically faster than FactSet's days/weeks of implementation and steep learning curve. Teams typically achieve full productivity within minutes rather than the extensive setup and training periods FactSet demands. The transition actually improves efficiency since modern alternatives eliminate FactSet's complex workflows that slow daily research.

Do FactSet alternatives offer better portfolio management features?

Yes, modern FactSet alternatives like Amsflow offer dramatically superior portfolio management features. While FactSet provides only basic portfolio tracking, Amsflow delivers world-class portfolio management with multi-asset tracking (stocks, crypto, ETFs, funds), multiple position support per symbol, intelligent benchmarking against major indices, real-time P&L calculations, 24/7 monitoring with customizable alerts, and seamless mobile access—capabilities that FactSet's limited system cannot match.

How do AI-powered FactSet alternatives compare to FactSet's manual approach?

AI-powered FactSet alternatives like Amsflow fundamentally transform investment research by understanding natural language queries, automatically generating sophisticated analysis, and providing intelligent insights without navigating through FactSet's complex interface. While FactSet requires manual navigation and significant training to build analysis, AI alternatives translate investment questions into comprehensive analysis instantly, reducing research time from hours to minutes while improving analytical depth beyond FactSet's manual workflows.

Which FactSet alternative is best for small investment firms vs large institutions?

Amsflow excels for both small investment firms and large institutions with scalable features. Small firms benefit from institutional-quality analysis at accessible pricing ($19/month vs FactSet's $1,000-$3,750/month) without setup complexity or training requirements, while larger teams access comprehensive collaboration features, shared analysis tools, and coordinated alert systems. Unlike FactSet's enterprise barriers, Amsflow provides institutional-grade capabilities accessible to firms of all sizes without prohibitive costs or complexity.

What features should I prioritize in a FactSet alternative?

Prioritize: institutional-quality data coverage matching FactSet's depth, AI-powered analysis and natural language search for efficiency, comprehensive portfolio management with advanced analytics, zero setup time vs FactSet's IT requirements, instant productivity vs FactSet's training investment, cost savings opportunity (70-99% potential reduction), team collaboration features, mobile optimization, intuitive user experience requiring no learning curve, and modern interface vs FactSet's enterprise complexity. The best FactSet alternatives transform prohibitive enterprise barriers into accessible professional-grade analysis.

Resources

Best Financial Analysis Platforms

Compare the best financial analysis platforms

Best SP Capital IQ Pro Alternatives

Compare the best SP Capital IQ Pro alternatives

Best Bloomberg Terminal Alternatives

Compare the best Bloomberg Terminal alternatives

Best YCharts Alternatives

Compare the best YCharts alternatives

Best Koyfin Alternatives

Compare the best Koyfin alternatives

Best Seeking Alpha Alternatives

Compare the best Seeking Alpha alternatives

Best Stock Screeners

Compare the best stock screeners

Best GuruFocus Alternatives

Compare the best GuruFocus alternatives

Best Simply Wall St Alternatives

Compare the best Simply Wall Street alternatives

Best FactSet Alternatives

Compare the best FactSet alternatives

Best TipRanks Alternatives

Compare the best TipRanks alternatives

Best MarketBeat Alternatives

Compare the best MarketBeat alternatives

Amsflow is for research and educational purposes only. Not financial advice. Amsflow doesn't recommend specific investments or securities. Market participation involves substantial risk, including potential loss of principal. Past performance doesn't guarantee future results. Amsflow doesn't offer fund/portfolio management services in any jurisdiction. Amsflow is a data platform only. Amsflow doesn't provide investment tips. Be cautious of imposters claiming to be Amsflow.