Best Finviz Alternatives — In-Depth Review & Comparison

Finviz has established itself as a popular stock screener with powerful heat maps and visual tools serving 25+ million users monthly. However, its limitations in global coverage, mobile accessibility, AI integration, portfolio management, and team collaboration are driving investment professionals toward more comprehensive alternatives that deliver superior functionality beyond US-only market screening.

The best Finviz alternatives combine visual screening capabilities with global market access,AI-powered insights, advanced portfolio management, team collaboration, andmobile optimization. We've evaluated how Amsflow compares against other Finviz alternatives including TradingView, Stock Rover, YCharts, TIKR, Seeking Alpha, and Koyfin to help you find the perfect Finviz replacement for your investment workflow.

Finviz vs Leading Alternatives

| Finviz Alternative Features | Finviz | Amsflow | TradingView | Stock Rover | YCharts | TIKR | Seeking Alpha |

|---|---|---|---|---|---|---|---|

| Modern UI/UX | Basic | Basic | Basic | Basic | Basic | ||

| AI-Powered Analysis | Basic | ||||||

| Portfolio Monitoring | Basic | Basic | Basic | ||||

| Screener | 20+ Filters | 500+ Metrics and 8000+ Filters | 700+ Metrics | Basic | 200+ Metrics | Basic | |

| Screener using natural language | |||||||

| Screener Inline Query Builder | |||||||

| Screener Global Coverage | US Only | US Only | Limited | US Only | |||

| Returns Heat Map | |||||||

| Comprehensive Alerts | Limited | Fundamental, Technical, Portfolio, and Market | Limited | Limited | Limited | Limited | Limited |

| Natural Language Search | |||||||

| World-class Portfolio Management | Basic | ||||||

| Multi-Asset Portfolio Tracking | Limited | Limited | |||||

| Team Collaboration | Shared Watchlists, Real-time Team Discussions, Team Portfolios, Team Alerts, Team Screens & Teams Series | Community | Basic | Basic | |||

| Correlation Analysis | Basic | ||||||

| Technical Charting | Basic | Technical indicators, Multi-Panel Chart Layouts, In-line Chart Alerts & Drawing Tools | Basic | Basic | Basic | Basic | |

| Fundamental Analysis | Basic | ||||||

| Global Market Data | US Only | US Only | Limited | US Only | |||

| Real-time Data | Elite Only | Limited | Limited | ||||

| Calendar Suite (Economic, Earnings, IPO) | Basic | Basic | Basic | Basic | |||

| Mobile Experience | Web Only | Web Only | Web Only | Web Only | |||

| Learning Curve | Low | Low | Low | Medium | Medium | Medium | Low |

| Setup Time | Minutes | Minutes | Minutes | Hours | Hours | Hours | Minutes |

| Enterprise Cost Per Seat (Annual) | $299.50 | $4,560+ | $2,100+ | $336+ | $3,600+ | $1,320+ | $2,388+ |

| Starting Price for Individual users | Freemium | $19/mo | Freemium | $7.99/mo | $300/mo | $24.95/mo | $19.99/mo |

Why Investors Are Seeking Finviz Alternatives

While Finviz offers excellent visual screening tools and heat maps with a generous free tier, several critical limitations are driving investment professionals toward more comprehensive alternatives:

Finviz Limitations

- US Markets Only: Limited to US stocks without global coverage, excluding OTC and ADRs.

- No Mobile App: Web-only interface that's not mobile-friendly.

- No AI Integration: Manual screening without intelligent insights or natural language search.

- No Team Collaboration: Individual-focused platform lacking shared workflows.

- Basic Portfolio Management: Portfolio tracker doesn't sync with brokerages.

- Limited Free Charting: Advanced charts and real-time data require Elite subscription.

Advanced Alternative Benefits

- Global Market Coverage: Access to 100,000+ securities across worldwide markets.

- Full Mobile Experience: Native apps with seamless cross-device functionality.

- AI-Powered Insights: Natural language queries and automated analysis.

- Advanced Team Collaboration: Real-time sharing, discussions, and coordinated workflows.

- World-class Portfolio Management: Brokerage sync with institutional-grade analytics.

- Advanced Charting Included: Comprehensive technical analysis without premium subscriptions.

Transform your investment journey with Amsflow

Powerfull Intelligence, Smart Alerts, Advanced Screening & Portfolio Tracking. Never miss movements, discover opportunities, analyze global markets. All in One Sleek Platform.

Amsflow — The Advanced Finviz Alternative

Amsflow stands out as the most comprehensive Finviz alternative, delivering everything investors appreciate about Finviz's visual screening capabilities while addressing its fundamental limitations. Unlike Finviz's US-only coverage and manual screening approach, Amsflow provides true global market access with 100,000+ securities worldwide and Lisa AI assistant that understands natural language queries like "Find undervalued dividend stocks with strong balance sheets in Europe" for instant sophisticated analysis across all markets—not just US stocks.What makes Amsflow the superior Finviz alternative is its combination of features that Finviz lacks entirely. While Finviz offers basic heat maps and screening, it's limited to US markets without mobile apps, team collaboration, or advanced portfolio management. Amsflow provides comprehensive multi-asset tracking across global markets (stocks, crypto, ETFs, funds), real-time data feeds, intelligent benchmarking against major indices, multiple position tracking per symbol with individual P&L calculations, and 24/7 portfolio monitoring with customizable threshold alerts. Combined with advanced team collaboration features including shared watchlists, real-time discussions, and coordinated alert systems, Amsflow transforms how investment teams work together—capabilities entirely absent from Finviz's individual-focused platform.

Why Choose Amsflow Over Finviz

- Global market coverage (100,000+ securities) vs Finviz's US-only limitation.

- Native mobile apps vs Finviz's web-only, non-mobile-friendly interface.

- AI-native platform with Lisa assistant and natural language search.

- World-class Portfolio suite with brokerage sync and multi-asset global tracking.

- Multiple position tracking per symbol with individual P&L calculations.

- Advanced team collaboration vs Finviz's individual-only focus.

- Comprehensive alert system with SMS, email, and webhook integrations.

- Advanced technical analysis with multi-panel layouts included.

- Real-time data included vs Finviz Elite requirement.

- Better value ($19/mo vs $24.96/mo Elite) with global functionality.

Considerations

- Finviz offers a robust free tier with heat maps.

- Finviz's visual heat maps are iconic for US market overview.

- Some users prefer Finviz's simplicity for US-only trading.

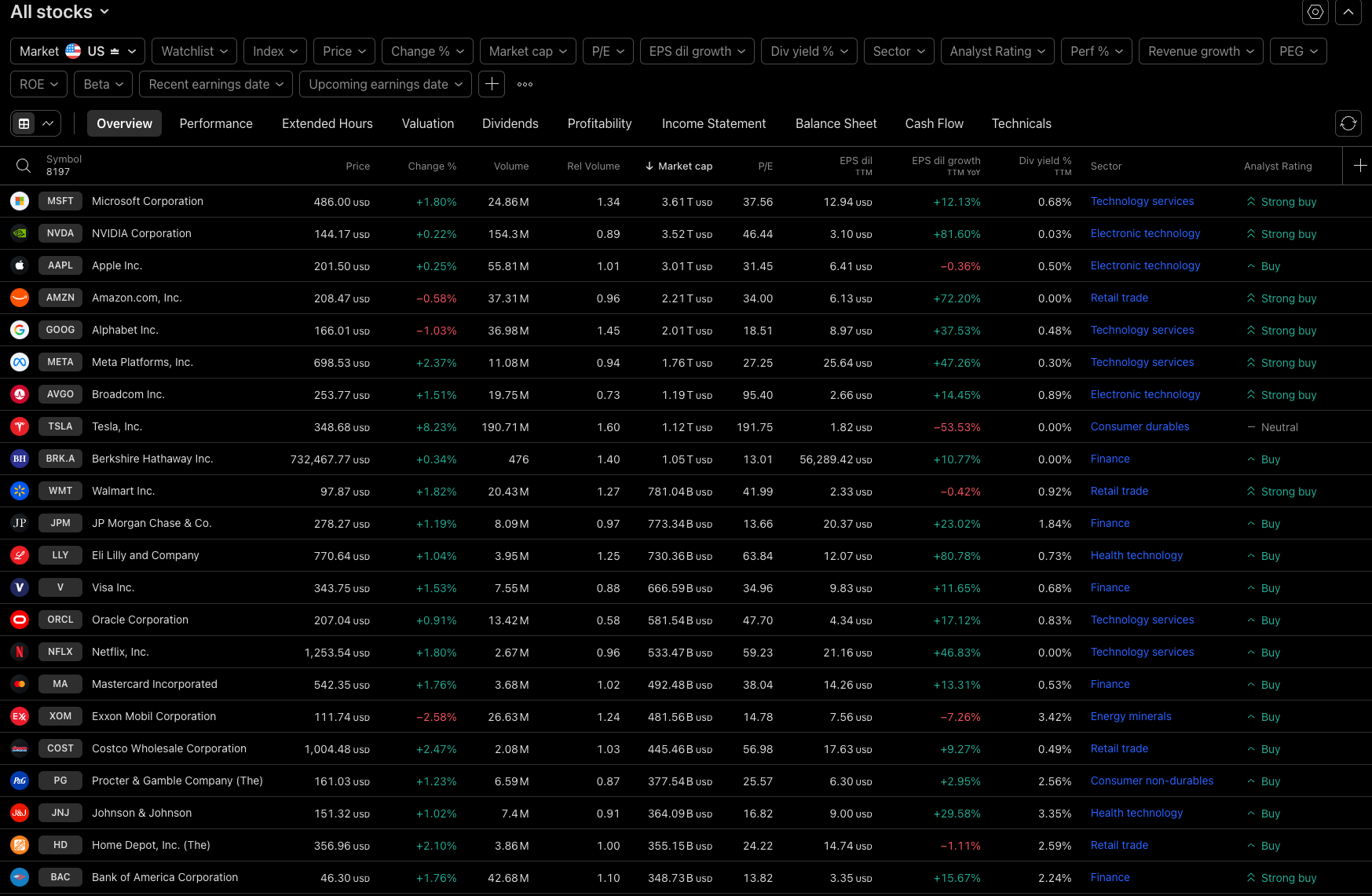

TradingView — The Charting-Focused Finviz Alternative

TradingView serves as a popular Finviz alternative with superior charting capabilities and global market coverage, addressing Finviz's US-only limitation. The platform excels in interactive charting with advanced technical analysis tools, vibrant community features, and custom indicators using Pine Script—capabilities that far exceed Finviz's basic charting functionality. TradingView's global coverage provides access to international markets that Finviz completely lacks.

As a Finviz alternative, TradingView offers exceptional charting capabilities, global coverage, and better mobile experience at competitive pricing. However, it lacks Finviz's strength in heat maps and visual market overviews, and provides weaker fundamental analysis screening compared to Finviz's comprehensive screener with 20+ filters focused on fundamentals.

Pros as Finviz Alternative

- Global market coverage vs Finviz's US-only limitation.

- Superior charting and technical analysis capabilities.

- Active community with custom indicators and ideas.

- Excellent mobile apps vs Finviz's web-only access.

- Lower starting price ($14.95/mo vs Finviz Elite $24.96/mo).

- Great user interface and experience.

Cons vs Comprehensive Finviz Alternatives

- No heat map visualization like Finviz's strength.

- Limited fundamental analysis vs Finviz's screening.

- Basic screening compared to Finviz's 20+ filters.

- No AI-powered insights or automation.

- Lacks portfolio management features.

- Community-focused rather than professional team workflows.

Stock Rover — The Metric-Heavy Finviz Alternative

Stock Rover serves as a Finviz alternative focused on comprehensive fundamental analysis with 700+ metrics, offering significantly deeper screening capabilities than Finviz's 20+ filters. The platform provides extensive portfolio management tools and advanced analytics that exceed Finviz's basic portfolio tracking, making it attractive to fundamental investors seeking more sophisticated analytical tools beyond Finviz's visual screening approach.

As a Finviz alternative, Stock Rover offers superior fundamental depth and portfolio management but shares Finviz's critical limitation of US-only coverage without global market access. The platform also lacks mobile apps, AI integration, and team collaboration features while requiring paid subscriptions for advanced features, unlike Finviz's generous free tier.

Pros as Finviz Alternative

- 700+ metrics vs Finviz's 20+ filters for deeper analysis.

- Advanced portfolio management vs Finviz's basic tracking.

- Lower starting price ($7.99/mo vs Finviz Elite $24.96/mo).

- Comprehensive screening capabilities.

- Strong fundamental analysis tools.

Cons vs Modern Finviz Alternatives

- US-only coverage like Finviz's limitation.

- No mobile app, web-only like Finviz.

- No AI integration or natural language search.

- No team collaboration features.

- No real-time data feeds.

- Lacks Finviz's visual heat maps.

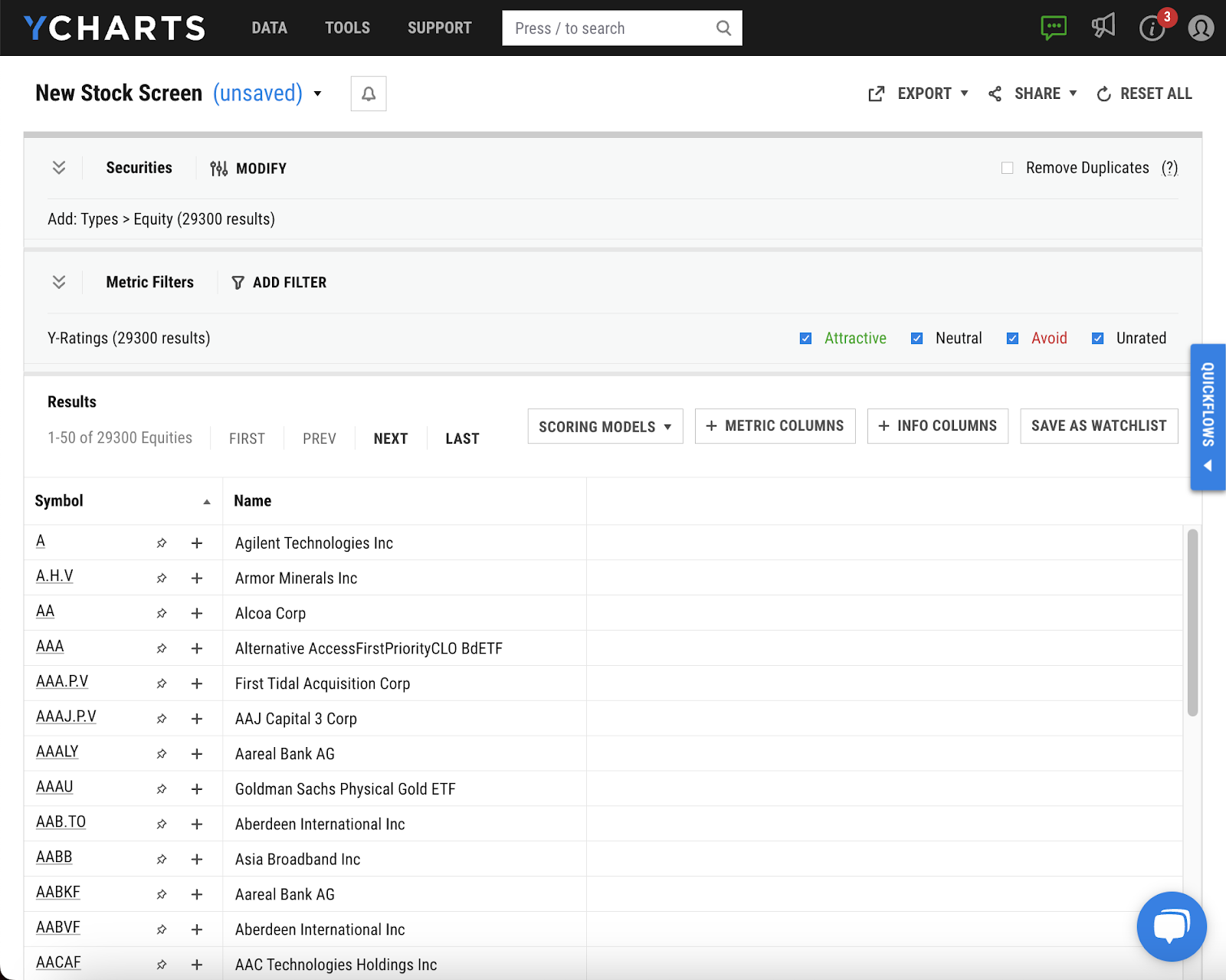

YCharts — The Professional Finviz Alternative

YCharts serves as a Finviz alternative focused on professional-grade fundamental data and presentation-ready charting, offering deeper data coverage than Finviz's screening tools. The platform excels in creating polished reports and charts for client presentations, providing more comprehensive fundamental analysis than Finviz with extensive historical data and advisor-focused workflows.

As a Finviz alternative, YCharts provides superior fundamental data depth and professional reporting tools but comes with significantly higher pricing ($300/month vs Finviz Elite's $24.96/month) and an outdated interface. The platform lacks the visual heat maps, quick screening, and user-friendly design that make Finviz popular among retail investors.

Pros as Finviz Alternative

- More extensive fundamental data than Finviz.

- Professional presentation and reporting capabilities.

- Strong Excel integration for data export.

- Comprehensive company analysis tools.

- Advisor-focused workflow design.

Cons vs Accessible Finviz Alternatives

- Much higher cost ($300+/mo vs Finviz Elite $24.96/mo).

- Outdated interface vs Finviz's visual design.

- US-focused coverage like Finviz's limitation.

- No visual heat maps like Finviz's strength.

- No AI features or natural language search.

- Poor mobile functionality.

TIKR — The Global Finviz Alternative

TIKR serves as a Finviz alternative with global market coverage, offering institutional-grade data from S&P Global across 100,000+ stocks in 92 countries—addressing Finviz's primary limitation of US-only coverage. The platform provides strong fundamental analysis capabilities with 200+ metrics and comprehensive screening tools, making it attractive to investors seeking Finviz-style screening with international market access.

As a Finviz alternative, TIKR offers superior global coverage and fundamental depth but lacks Finviz's visual heat maps, quick visual market overviews, and generous free tier. The platform also shares similar limitations including no AI integration, no team collaboration, limited technical analysis, and web-only access without mobile apps.

Pros as Finviz Alternative

- Global coverage (100,000+ stocks) vs Finviz's US limitation.

- Similar pricing ($24.95/mo vs Finviz Elite $24.96/mo).

- S&P Global institutional-grade data.

- Strong fundamental analysis and screening.

- Superinvestor portfolio tracking feature.

Cons vs Visual Finviz Alternatives

- No visual heat maps like Finviz's iconic feature.

- No free tier like Finviz's generous offering.

- No AI features or natural language search.

- Limited technical analysis capabilities.

- Web-only access without mobile apps.

- No team collaboration features.

Seeking Alpha — The Content-Focused Finviz Alternative

Seeking Alpha serves as a Finviz alternative focused on community insights and analyst research, offering screening tools combined with extensive editorial content and crowdsourced opinions. The platform provides basic screening capabilities, portfolio tracking, and access to thousands of analyst articles and earnings call transcripts, making it attractive to investors seeking screening tools with additional qualitative research perspectives beyond Finviz's quantitative focus.

As a Finviz alternative, Seeking Alpha offers superior research content and community insights but lacks Finviz's visual heat maps, comprehensive screening filters (fewer metrics than Finviz's 20+ filters), and rapid market discovery capabilities. The platform's strength lies in qualitative research rather than the quantitative visual screening that makes Finviz popular.

Pros as Finviz Alternative

- Similar pricing ($19.99/mo vs Finviz Elite $24.96/mo).

- Extensive analyst articles and research content.

- Community insights and crowdsourced opinions.

- Earnings call transcripts and alerts.

- Mobile app available vs Finviz's web-only.

Cons vs Screening-Focused Finviz Alternatives

- No visual heat maps like Finviz's strength.

- Limited screening vs Finviz's 20+ filters.

- Basic portfolio management tools.

- US-focused coverage like Finviz's limitation.

- No advanced technical analysis.

- Content-focused rather than visual screening.

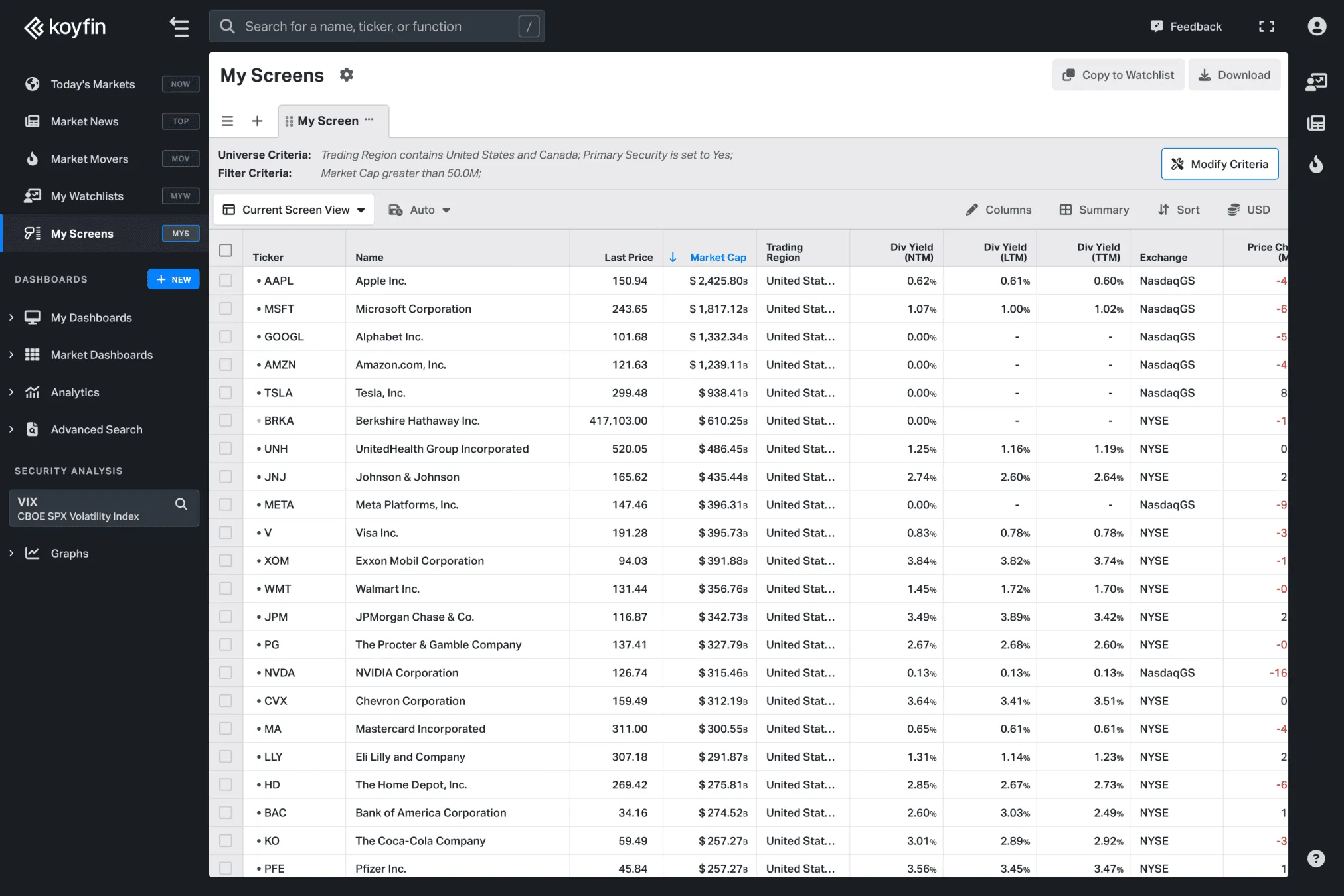

Koyfin — The Macro-Focused Finviz Alternative

Koyfin serves as a Finviz alternative with stronger macroeconomic focus and cleaner modern interface, offering good fundamental data coverage and screening capabilities similar to Finviz's approach. The platform provides solid global market coverage—addressing Finviz's US-only limitation—and reasonable charting capabilities with better macro dashboard features than Finviz's market-focused screener.

As a Finviz alternative, Koyfin offers global coverage and better macro analysis but lacks Finviz's iconic visual heat maps, rapid screening speed, and generous free tier with delayed data access. The platform also shares similar limitations including no AI integration, basic portfolio management, and limited team collaboration features.

Pros as Finviz Alternative

- Global coverage vs Finviz's US-only limitation.

- Free tier available like Finviz.

- Clean, modern interface design.

- Strong macroeconomic analysis tools.

- Good fundamental data coverage.

Cons vs Visual Finviz Alternatives

- No visual heat maps like Finviz's iconic feature.

- No AI features or natural language search.

- Basic portfolio management like Finviz.

- Limited team collaboration features.

- Web-only access without mobile apps.

- Slower screening vs Finviz's rapid discovery.

The Best Finviz Alternative for Modern Investors

After comprehensive analysis, Amsflow emerges as the superior Finviz alternative for investment professionals seeking comprehensive screening capabilities beyond US markets. While Finviz offers excellent visual heat maps and screening with a generous free tier, its limitations in global coverage, mobile accessibility, AI integration, portfolio management, and team collaboration make it insufficient for today's global investment workflows.

Amsflow delivers everything investors appreciate about Finviz's visual screening approach while adding critical capabilities Finviz lacks: global market coverage across 100,000+ securities, native mobile apps with seamless functionality, AI-powered insights with natural language search, world-class portfolio management with brokerage sync, comprehensive team collaboration features, and advanced technical analysis tools. At competitive pricing ($19/month vs Finviz Elite's $24.96/month), Amsflow provides dramatically superior global functionality with better user experience and professional-grade features.

For investment teams ready to move beyond Finviz's US-only limitations while maintaining visual screening power and cost efficiency, Amsflow represents the clear choice among Finviz alternatives.

Transform your investment journey with Amsflow

Powerfull Intelligence, Smart Alerts, Advanced Screening & Portfolio Tracking. Never miss movements, discover opportunities, analyze global markets. All in One Sleek Platform.

Finviz Alternatives FAQ

Why are investors looking for Finviz alternatives?

Investors are seeking Finviz alternatives due to its US-only market coverage without global access, no mobile app with non-mobile-friendly web interface, lack of AI integration for automated analysis, no team collaboration features, basic portfolio management without brokerage sync, and Elite subscription required for real-time data. While Finviz offers excellent visual screening with heat maps, modern investment professionals need global coverage, mobile accessibility, AI-powered insights, and team workflows that Finviz cannot provide.

Which Finviz alternative offers the best combination of features and value?

Amsflow offers the best combination of features and value among Finviz alternatives, providing global market coverage (100,000+ securities vs Finviz's US-only), native mobile apps, real-time data included, AI-powered analysis, world-class portfolio management, and comprehensive team collaboration at $19/month—better value than Finviz Elite's $24.96/month with US-only coverage. Unlike other alternatives that either lack features or cost significantly more, Amsflow addresses every Finviz limitation while maintaining competitive pricing.

Can Finviz alternatives provide global market coverage?

Yes, leading Finviz alternatives like Amsflow, TradingView, TIKR, and Koyfin provide comprehensive global market coverage. While Finviz is limited to US stocks only (excluding even OTC and ADRs), Amsflow offers access to 100,000+ securities across global markets including Europe, Asia, and emerging markets. This global coverage is essential for diversified portfolios and international investment strategies that Finviz's US-only limitation prevents.

What should I consider when switching from Finviz to an alternative?

When switching from Finviz, consider: global market coverage for international investing, mobile app availability for on-the-go screening, AI-powered analysis capabilities for automated insights, team collaboration tools for workflow efficiency, portfolio management depth with brokerage sync, real-time data access without premium requirements, and total value proposition. Most Finviz alternatives offer free trials—test them with your actual screening workflows to compare functionality improvements beyond Finviz's US-only visual screening.

How do AI-powered Finviz alternatives compare to Finviz's manual screening?

AI-powered Finviz alternatives like Amsflow fundamentally transform investment screening by understanding natural language queries, automatically generating sophisticated filters, and providing intelligent insights without manual configuration. While Finviz requires users to manually select from 20+ filters and understand screening parameters, AI alternatives translate human intent like "undervalued dividend stocks in Europe" into comprehensive screens instantly, reducing research time while improving global discovery capabilities beyond Finviz's US-only manual approach.

Do Finviz alternatives offer better mobile experiences?

Yes, modern Finviz alternatives like Amsflow, TradingView, and Seeking Alpha offer significantly superior mobile experiences. While Finviz has no mobile app and its web interface is not mobile-friendly, advanced alternatives provide native mobile apps with seamless functionality across devices, enabling on-the-go screening, portfolio monitoring, and market analysis. This mobile optimization is essential for active investors who need market access beyond desktop computers—a critical gap in Finviz's offering.

Which Finviz alternative is best for visual market screening?

Amsflow excels for visual market screening, offering heat map functionality similar to Finviz's iconic feature while adding global coverage, AI-powered insights, and advanced filtering with 8000+ options. While Finviz's heat maps are excellent for US market overview, Amsflow provides visual performance tracking across global markets with Returns Heat Map, comprehensive screening capabilities, and intuitive workflows. Unlike Finviz which limits visual screening to US stocks, Amsflow enables visual discovery across worldwide markets.

Can I use multiple Finviz alternatives together?

While some investors combine multiple platforms—for example, using TradingView for advanced charting alongside Finviz for heat map screening—comprehensive alternatives like Amsflow often eliminate the need for multiple subscriptions. Amsflow provides visual heat maps, global screening, advanced charting, comprehensive fundamental analysis, portfolio management, and team collaboration in one integrated platform, simplifying workflows while reducing costs compared to managing multiple tools like Finviz plus international data services.

What features should I prioritize in a Finviz alternative?

Prioritize: global market coverage beyond US stocks, native mobile apps for on-the-go screening, AI-powered analysis and natural language search for efficiency, comprehensive portfolio management with brokerage sync, real-time data included without premium requirements, visual screening tools similar to Finviz's heat maps, team collaboration features for coordinated workflows, advanced filtering capabilities, competitive pricing, and intuitive user experience. The best Finviz alternatives enhance visual screening power while addressing Finviz's geographic and mobile limitations.

Resources

Best Financial Analysis Platforms

Compare the best financial analysis platforms

Best SP Capital IQ Pro Alternatives

Compare the best SP Capital IQ Pro alternatives

Best Bloomberg Terminal Alternatives

Compare the best Bloomberg Terminal alternatives

Best YCharts Alternatives

Compare the best YCharts alternatives

Best Koyfin Alternatives

Compare the best Koyfin alternatives

Best Seeking Alpha Alternatives

Compare the best Seeking Alpha alternatives

Best Stock Screeners

Compare the best stock screeners

Best GuruFocus Alternatives

Compare the best GuruFocus alternatives

Best Simply Wall St Alternatives

Compare the best Simply Wall Street alternatives

Best FactSet Alternatives

Compare the best FactSet alternatives

Best TipRanks Alternatives

Compare the best TipRanks alternatives

Best MarketBeat Alternatives

Compare the best MarketBeat alternatives

Best Zacks Alternatives

Compare the best Zacks alternatives

Best TIKR Alternatives

Compare the best TIKR alternatives

Best Stock Rover Alternatives

Compare the best Stock Rover alternatives

Best Finviz Alternatives

Compare the best Finviz alternatives

Amsflow is for research and educational purposes only. Not financial advice. Amsflow doesn't recommend specific investments or securities. Market participation involves substantial risk, including potential loss of principal. Past performance doesn't guarantee future results. Amsflow doesn't offer fund/portfolio management services in any jurisdiction. Amsflow is a data platform only. Amsflow doesn't provide investment tips. Be cautious of imposters claiming to be Amsflow.